Over the next few weeks, as your employees start to receive their 2024 W-2 form, they will likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns a salary of $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. Some employees may also wonder why their Federal Income Tax withheld…

Posts published in “W-4”

Did you hire someone who is giving you pushback on submitting a W-4 form, or maybe they even presented you with a little-known tax form stating that they do not pay taxes? If so, you may have hired a tax protestor. No need to panic; you may be able to talk some sense into them. Tax protestors could simply be misinformed individuals, and with social media exposure, that is easy to come by. I have seen TikTok videos, X posts, YouTube and the like, falsely leading people down this path. They claim that taxation is voluntary, does not apply to…

Over the next few weeks, as your employees start to receive their 2022 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. Some employees may also wonder why their Federal Income Tax withheld is…

Over the next few weeks, as your employees start to receive their 2021 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. Some employees may also wonder why their Federal Income Tax withheld is…

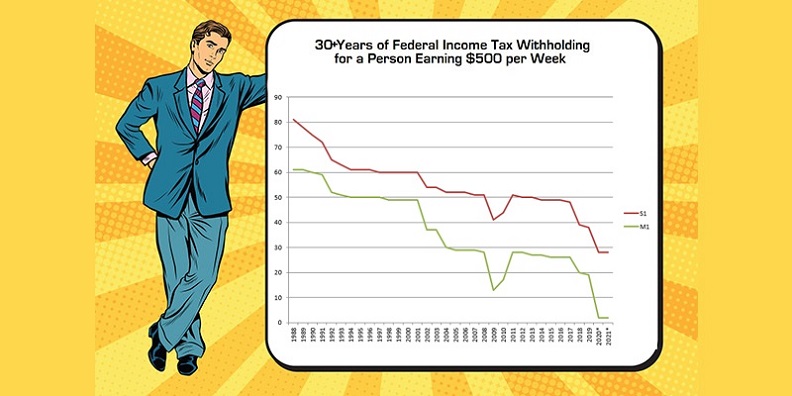

Almost three years ago, I wrote an article about the steady decline in the amount of federal income tax withheld from an employee’s check over the past three decades. This was prior to the new 2020 Form W-4 redesign, so I thought it would be interesting to revisit this chart and see its effect. As we saw three years ago, the amount of income tax withheld from an employee claiming Single with One allowance or Married with One allowance has steadily decreased, with the exception of 2009 where there was a sharp decrease that eventually returned to its pre-depression state…

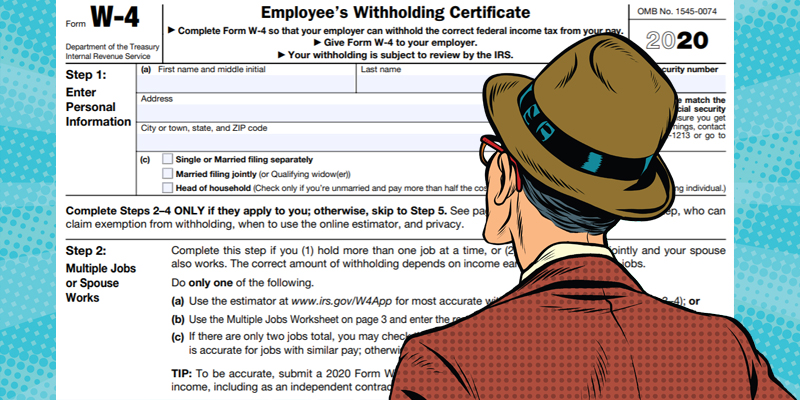

There has been no change to the 2021 W-4 Form from the recently re-designed 2020 version, other than the tax table, but there has been a bit of confusion. First off, the IRS encourages the use of the new form, but it is not required for 2021. Employees will find a more accurate withholding and, most likely, enjoy a higher net pay on every check if they do complete a new form. Payroll systems that utilize the new tax withholding table have recently been provided the ability to ‘bridge’ the 2019 and earlier form as if they were the the…

Unless you live and work in one of the following nine states that do not tax wages, you are required to withhold state income tax on wages paid to your employees: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. While this may sound simple enough, there are a number of considerations that need to be made, and we will go over them here, including the COVID-19 wrench in the machine. The Form First up is the form itself. There are a few states that did not adopt their own state withholding tax form, so here is…

The 2020 Form W-4, Employee’s Withholding Certificate, is very different from previous versions. This is due to the federal tax law changes that took place in 2018 from the 2017 Tax Cuts and Jobs Act. Check out my prior article with a bit of history and nostalgia of a 30 year old form. https://blog.paymaster.com/here-it-comes-2020-w4-form/ The most significant change is that there is no longer the use of withholding allowances, and the form asks the employee to basically prepare an estimated tax return. Some of the information requested may even be considered intrusive, including income from other sources, spouse income, itemized…

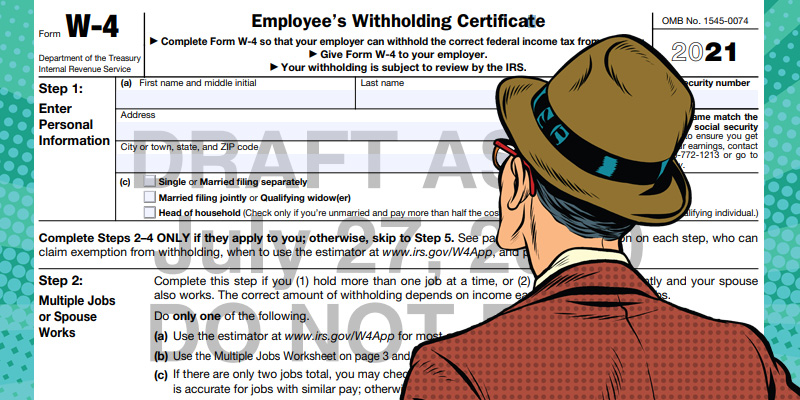

The W-4 form has remained basically unchanged for many decades. For a flashback, here is what it looked like in 1990: https://www.irs.gov/pub/irs-prior/fw4–1990.pdf. Unchanged until now, that is. The IRS has done a complete revamp of the form for 2020 by adding many additional fields for the employee to complete as well as removing ‘number of allowances.’ You may ask how that can be since the number of allowances basically dictated the amount of federal income tax withheld from a paycheck. You need to see the new form to believe it, and here it is: https://www.irs.gov/pub/irs-dft/fw4–dft.pdf. The form asks the employee…

Whew! We dodged a bullet… at least for another year. If you are not familiar with what the 2019 W-4 form could have looked like, then keep an eye out for a future article where we will give it a thorough review as it is now postponed for 2020 by the U.S. Treasury. The new 2019 W-4 form has been published (including the Spanish W-4(SP) version) and not much is changed from the 2018 version. A Form W-4 remains in effect until the employee gives you a new one, so you do not need to obtain a new form each year. When…