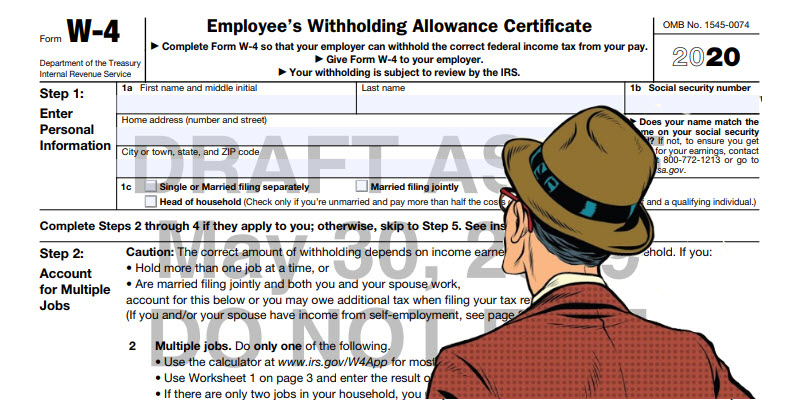

The W-4 form has remained basically unchanged for many decades. For a flashback, here is what it looked like in 1990: https://www.irs.gov/pub/irs-prior/fw4–1990.pdf. Unchanged until now, that is. The IRS has done a complete revamp of the form for 2020 by adding many additional fields for the employee to complete as well as removing ‘number of allowances.’ You may ask how that can be since the number of allowances basically dictated the amount of federal income tax withheld from a paycheck. You need to see the new form to believe it, and here it is: https://www.irs.gov/pub/irs-dft/fw4–dft.pdf.

The form asks the employee for information such as ‘other income’ and ‘number of qualifying children and dependents,’ as well as how much in itemized deductions one may be claiming when they file their 1040 at year- end. The form itself is no longer one-third of the bottom of the page; it now takes up the full sheet plus three more pages of worksheets, instructions and tables. I believe it is actually enough for one to consult their CPA/tax preparer to assist with completion of this form. For those employees who do not want to provide their employer with this information, or want a “most accurate withholding amount,” there is going to be an app available online at https://www.irs.gov/w4app. This will allow the employee to complete a Q&A online and the end result will provide numbers to fill in on the form to submit to the employer.

Also, as of this writing, there appears to be a transition year. All new employees should complete this 2020 form and existing employees hired prior to the form can maintain their existing ‘Allowances’ withholding method. By 2021, all employees will need to be on the new withholding form. We will keep you updated as this form develops and a final form is released.

UPDATE 08/08/2019 – It looks like we may have a somewhat final draft of the 2020 W-4 form. I am happy with the latest changes and it has certainly come a long way from the initial version that was release last year. For the full Treasury press release, here it is https://home.treasury.gov/news/press-releases/sm753

along with a copy of the latest draft here https://www.irs.gov/pub/irs-dft/fw4–dft.pdf