The month of June is the start of summer, but for those in southeastern states, June 1st marks the start of hurricane season. Hurricane preparedness often includes stocking up on supplies and being at the ready for physical damage to a business, but another equally important aspect is having a plan to pay your employees. At PayMaster, we have been right in the thick of things, operating our headquarters out of South Florida. Over our past 30 years, we have maintained service before, during and after any and all hurricanes that have come our way. This is due to critical…

Posts published in “PayMaster HCM”

OSHA Recordkeeping and Reporting Begins February 1 The Occupational Safety and Health Act of 1970 created the Occupational Safety and Health Administration (OSHA) to ensure safe and healthful working conditions for workers. It is a division of the U.S. Department of Labor and they set and enforce standards, as well as reporting requirements. In short, it is one more set of government regulations many businesses will need to comply with, or otherwise, face penalties. Form 300A Posting Requirement From February 1 to April 30, 2025, covered employers* with 11 or more employees at any time in 2024, must post OSHA…

E-Verify is now mandated to be performed on all new employees in the state of Florida. Check out this webinar replay for all the information you need to know.

On August 1, 2023, the U.S. Citizenship and Immigration Services published the latest version of Form I-9. The new version can be downloaded here: https://www.uscis.gov/i-9. Employers should begin to use this new form immediately, and starting November 1, 2023, ONLY this new version will be allowed. If your employees use PayMaster HCM to complete the Form I-9, we will update to the new version in the coming weeks. There are many big changes with this version. Wording has been changed from ‘alien’ to ‘noncitizen,’ which I always thought was weird in the first place, and the form was redesigned to…

Florida Governor Ron DeSantis signed Florida’s Senate Bill 1718 into law on May 10, 2023. This bill has a broad purpose to obstruct the flow of illegal immigration in the state and imposes some of the toughest penalties in the country. It ‘enhances’ the crime of human smuggling, which is a good thing, but imposes a new rule for employers in the state. Effective July 1, 2023, private employers with 25 or more employees, and public employers, are now required to use the federal E-Verify system to verify employment eligibility of ALL new hires. There is NO requirement to verify employees who began employment prior to that effective date. So…

All private employers, even Old MacDonald, who are subject to Title VII of the Civil Rights Act of 1964 (as amended by the EEO Act of 1972) with 100 or more employees and have establishments located in the 50 states or DC are required to file the Standard Form 100 (aka EEO-1) each year. The due date changes each year, and is often extended. As of the time of this article, the 2021 filing is due by Tuesday, May 17, 2022. This includes state and local governments, primary and secondary school systems, institutions of higher education, Indian tribes, and tax-exempt…

On October 28, 2021, the U.S. Department of Labor (DOL) issued a Final Rule, which takes effect on December 28, 2021; it is extremely important for businesses that pay the lower “tipped minimum wage” to take notice. In this final rule, the DOL finalizes its proposal to withdraw one portion of the Tip Regulations Under the Fair Labor Standards Act (FLSA 2020 Tip Final Rule) and finalize its proposed revisions related to the determination of when a tipped employee is employed in dual jobs under the Fair Labor Standards Act of 1938. Specifically, the Department of Labor is amending its…

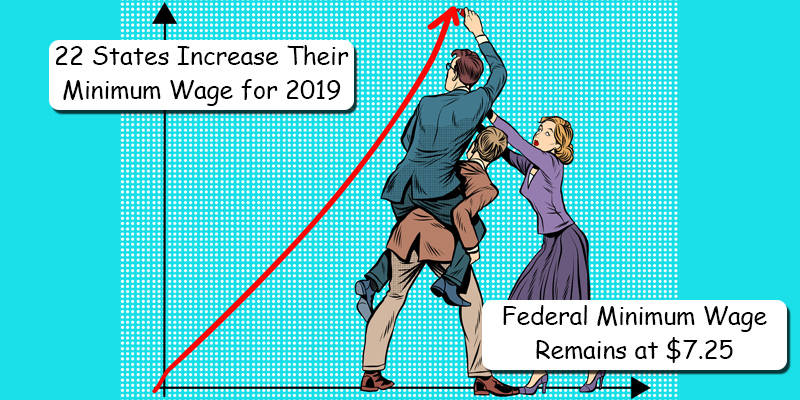

While the Federal minimum wage remains at $7.25 per hour, 22 states and many cities/locals have set increases effective January 1st, 2018 with a few announcing a July 1st, 2019 increase, and New York with a December 31st, 2018 increase. A list of each state/local, along with the new hourly rate is listed below; All rates are effective January 1st, 2019 unless otherwise noted. Alaska: $9.89 an hour Arizona: $11.00 Flagstaff: $12.00 Arkasnsas: $9.25 California: $12.00 for businesses with 26 or more employees; $11.00 for businesses with 25 or fewer employees Alameda: $13.50 Belmont: $13.50 Cupertino: $15.00 El Cerrito: $15.00 Los Altos: $15.00 Los Angeles: (7/1/2019) $14.25 for businesses with 26 or more employees;…

A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

E-Verify started as a pilot program in 1997 to help employers verify the work authorization of new hires. When you have an employee complete a USCIS Form I-9, you are taking the word of the employee and the face value of the documents they provide. E-Verify allows you to confirm the provided documentation against multiple government databases. All employers must first complete an I-9 form for every new hire, within three business days of the date the employee starts work. Employers must not begin the I-9 process until after the individual is hired. The newly-hired employee jointly completes the I-9 form…