We are often asked, in regards to rehires, if a new Form I-9 or E-Verify case is required. Employers have the option of treating all rehired employees as new hires by completing a new Form I-9 and creating a case in E-Verify. This may be the best practice because you will always have your bases covered. The only downside is the time it takes to perform the possible repetitive work. If you rehire a former employee within three years of the initial execution of the previous Form I-9 but did not create an E-Verify case and receive an ‘employment authorized’ response…

Posts published in “Forms”

On August 1, 2023, the U.S. Citizenship and Immigration Services published the latest version of Form I-9. The new version can be downloaded here: https://www.uscis.gov/i-9. Employers should begin to use this new form immediately, and starting November 1, 2023, ONLY this new version will be allowed. If your employees use PayMaster HCM to complete the Form I-9, we will update to the new version in the coming weeks. There are many big changes with this version. Wording has been changed from ‘alien’ to ‘noncitizen,’ which I always thought was weird in the first place, and the form was redesigned to…

Florida Governor Ron DeSantis signed Florida’s Senate Bill 1718 into law on May 10, 2023. This bill has a broad purpose to obstruct the flow of illegal immigration in the state and imposes some of the toughest penalties in the country. It ‘enhances’ the crime of human smuggling, which is a good thing, but imposes a new rule for employers in the state. Effective July 1, 2023, private employers with 25 or more employees, and public employers, are now required to use the federal E-Verify system to verify employment eligibility of ALL new hires. There is NO requirement to verify employees who began employment prior to that effective date. So…

Over the next few weeks, as your employees start to receive their 2022 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. Some employees may also wonder why their Federal Income Tax withheld is…

The last time I wrote about Social Security Numbers (SSNs) over four years ago, it was a fun and educational piece about the history of the SSN. You can check it out at this link: https://blog.paymaster.com/a-history-and-education-about-the-ssn/ These days, the SSN has become more important than ever, and it is of utmost importance to get it right. Of course, you should always get the SSN right for compliance with the Department of Homeland Security and the IRS, but that does not always happen. The filing of state employment and unemployment taxes has become more sophisticated over the recent years by utilizing…

Over the next few weeks, as your employees start to receive their 2021 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. Some employees may also wonder why their Federal Income Tax withheld is…

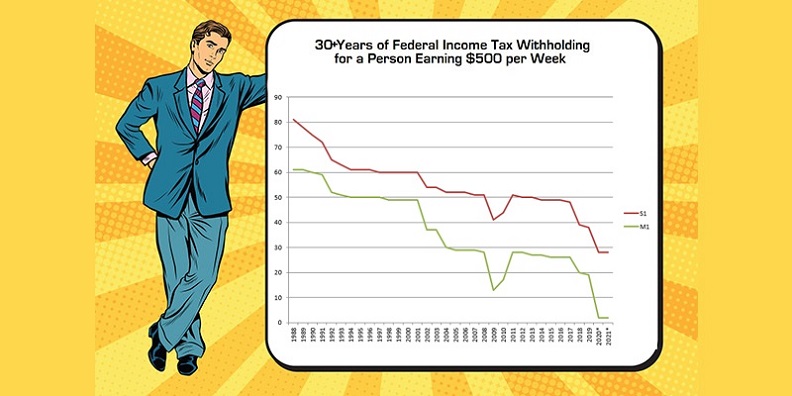

Almost three years ago, I wrote an article about the steady decline in the amount of federal income tax withheld from an employee’s check over the past three decades. This was prior to the new 2020 Form W-4 redesign, so I thought it would be interesting to revisit this chart and see its effect. As we saw three years ago, the amount of income tax withheld from an employee claiming Single with One allowance or Married with One allowance has steadily decreased, with the exception of 2009 where there was a sharp decrease that eventually returned to its pre-depression state…

There has been no change to the 2021 W-4 Form from the recently re-designed 2020 version, other than the tax table, but there has been a bit of confusion. First off, the IRS encourages the use of the new form, but it is not required for 2021. Employees will find a more accurate withholding and, most likely, enjoy a higher net pay on every check if they do complete a new form. Payroll systems that utilize the new tax withholding table have recently been provided the ability to ‘bridge’ the 2019 and earlier form as if they were the the…

Unless you live and work in one of the following nine states that do not tax wages, you are required to withhold state income tax on wages paid to your employees: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. While this may sound simple enough, there are a number of considerations that need to be made, and we will go over them here, including the COVID-19 wrench in the machine. The Form First up is the form itself. There are a few states that did not adopt their own state withholding tax form, so here is…

The 2020 Form W-4, Employee’s Withholding Certificate, is very different from previous versions. This is due to the federal tax law changes that took place in 2018 from the 2017 Tax Cuts and Jobs Act. Check out my prior article with a bit of history and nostalgia of a 30 year old form. https://blog.paymaster.com/here-it-comes-2020-w4-form/ The most significant change is that there is no longer the use of withholding allowances, and the form asks the employee to basically prepare an estimated tax return. Some of the information requested may even be considered intrusive, including income from other sources, spouse income, itemized…