There has been no change to the 2021 W-4 Form from the recently re-designed 2020 version, other than the tax table, but there has been a bit of confusion.

First off, the IRS encourages the use of the new form, but it is not required for 2021. Employees will find a more accurate withholding and, most likely, enjoy a higher net pay on every check if they do complete a new form. Payroll systems that utilize the new tax withholding table have recently been provided the ability to ‘bridge’ the 2019 and earlier form as if they were the the 2020 or later form. This computational bridge is identified in Publication 15-T, where up to four computational adjustments are made that will allow the old form to be continued. Be aware that the computational bridge only applies to forms that were in effect on or before December 31, 2019, and that continue in effect because an employee didn’t submit a 2020 or later form. If an employee is either required, or chooses to submit a new form, it doesn’t change the requirement that the employee must use the current year’s revision of the form.

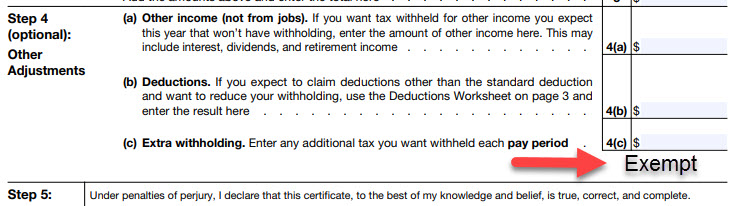

If an employee needs to change their withholding, then, of course, they must use the new form, but there is a situation where an employee is REQUIRED to complete a new 2020 or 2021 form. Any employee who claimed ‘Exempt’ from withholding is required to complete a new form by February 15, 2021; if a new form is not submitted by this date, then treat the employee as if they failed to provide a new form. It may not be clear how an employee would claim ‘Exempt’ on the new form as there is no box to indicate this on the face of the new form. The instructions direct the employee to write ‘Exempt’ below field 4(c) as shown below:

Employees who fail to furnish a W-4 Form will be treated as if they had checked the box for ‘Single or Married filing separately’ in Step 1(c) and made no entries in any other step. If the employee was paid wages before 2020 and who failed to furnish a new form, he/she should continue to be treated as Single and claim zero allowances.

To minimize your exposure to liability of providing incorrect guidance, we do not suggest that you assist your employees in completing the form. The IRS provides many resources that you can direct your employees to, including the W-4 App that will ask the employees a series of questions before providing the data to fill out the form. The App can be found at irs.gov/w4app. There is also a video and a FAQ provided by the IRS, and two explanation documents that we have created which can be found at this link.

No different than prior years, the employer does not need to send a copy of the W-4 Form to the IRS under any condition. In the past, employers were required, if the employee indicated they were Exempt or indicated 10 or more Allowances. The IRS states that the employer must maintain their copy for a minimum of four years after the date that the taxes were due or paid, whichever is later. Since this form is not actually used to report taxes due or paid, my translation of this requirement is to keep the form for as long as it is used for calculation of withholding tax and for four years after the W-2 is filed for that year, based on the W-2 filing date to Social Security Administration (SSA).

The form may become invalid if there are any modifications or inclusions other than the entries requested. A little known fact is that the form may also become invalidated if the employee indicates, in any way, that it’s false. For example, if the employee claims $6,000 in Step 3 and hands it to you with the explanation, ‘I don’t have any dependents and I am just doing that so I have less income tax withheld,’ the employee just made that an invalid form. When you receive an invalid form, tell the employee that it’s invalid and ask for another one. Continue to withhold based on the previous Form provided, or Single with no other adjustments, if there is no previous form.

While I make every attempt to ensure the accuracy and reliability of the information provided in this article, the information is provided “as-is” without warranty of any kind. PayMaster, Inc. and Romeo Chicco do not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained. Consult with your CPA, Attorney, and/or HR Professional.