The subject of workers’ compensation is an expansive topic that we will tackle in a series of blogs. Part I will cover who is covered, and future articles will tackle wages, audits, and more. Workers’ compensation insurance is a requirement for just about every business operating in the U.S. There are few exceptions, which are determined at the state level; for example, Florida, where the requirement is four or more employees, including business owners who are corporate officers or Limited Liability Company (LLC) members, in a non-construction industry business. For a construction industry business operating in Florida, you only need…

Posts published in “1099”

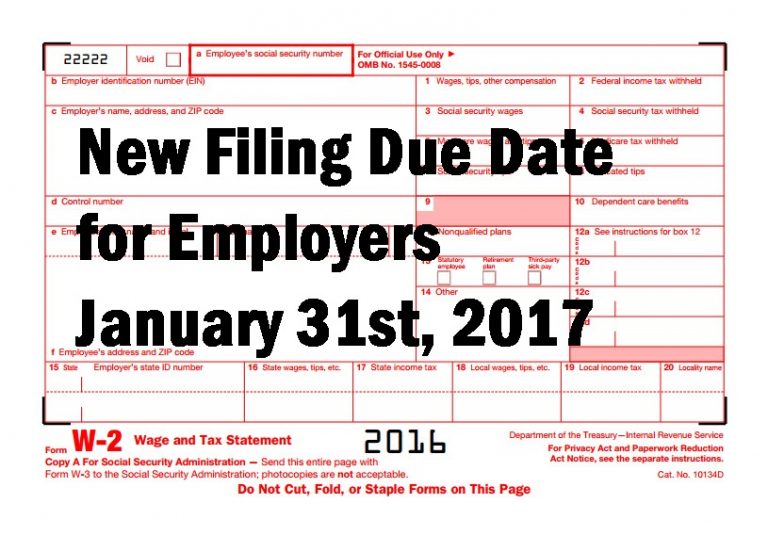

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…

The death of an employee is a difficult time for any business. Grieving co-workers, loss of productivity, and finding and training a replacement are just a few of the factors a business will need to deal with, but one area that is often mishandled is the treatment of wages and payroll. How payroll is handled is all about timing, and I can break it down into three distinct parts. Part 1 – Wages earned and paid prior to the death For wages paid to the employee prior to the death, where the payroll check remains uncashed, a stop payment should…