E-Verify started as a pilot program in 1997 to help employers verify the work authorization of new hires. When you have an employee complete a USCIS Form I-9, you are taking the word of the employee and the face value of the documents they provide. E-Verify allows you to confirm the provided documentation against multiple government databases. All employers must first complete an I-9 form for every new hire, within three business days of the date the employee starts work. Employers must not begin the I-9 process until after the individual is hired. The newly-hired employee jointly completes the I-9 form…

Posts published in March 2018

All private employers, even Old MacDonald, who are subject to Title VII of the Civil Rights Act of 1964 (as amended by the EEO Act of 1972) with 100 or more employees and have establishments located in the 50 states or DC are required to file the Standard Form 100 (aka EEO-1) on or before March 31st of each year. This includes state and local governments, primary and secondary school systems, institutions of higher education, Indian tribes, and tax-exempt private membership clubs other than labor organizations. Companies with centralized ownership, control, or management count all employees across all organizations to…

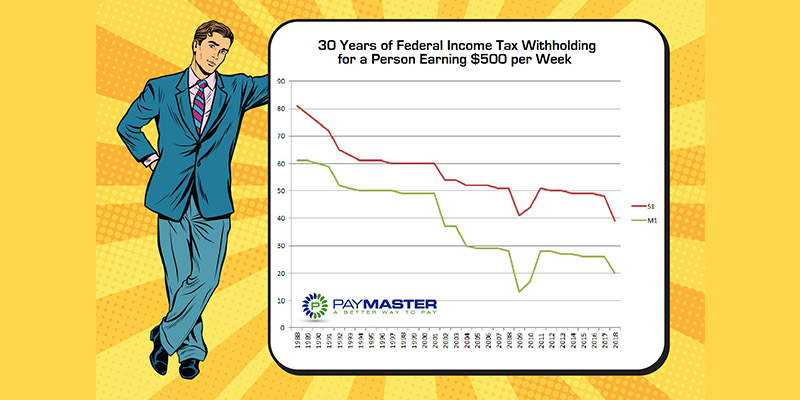

If you are like me, you have been at the edge of your seat waiting for the IRS to release the 2018 Form W-4, Employee Withholding Allowance Certificate since January 1st. Well, on February 28th the wait ended, and here is the new form in all four pages of glory. Yes, four pages. Double the prior year’s 1 page front and back form. At the end of the day, the certificate itself is still just a 1/3 of the first page where the employee will basically indicate whether they are withholding at Single, Married, or Married, but withhold at the higher…