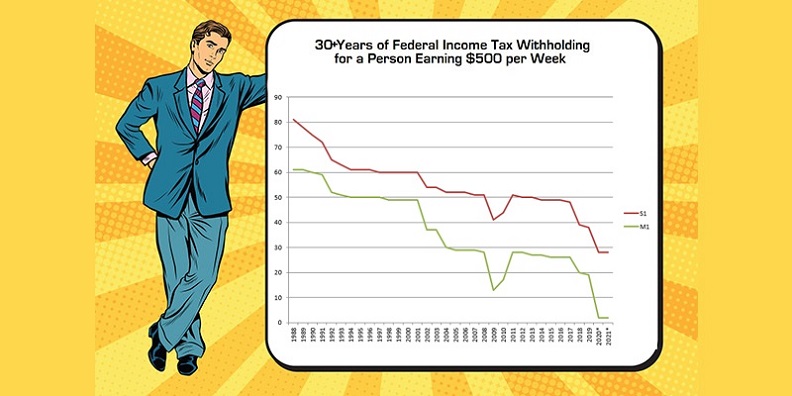

Almost three years ago, I wrote an article about the steady decline in the amount of federal income tax withheld from an employee’s check over the past three decades. This was prior to the new 2020 Form W-4 redesign, so I thought it would be interesting to revisit this chart and see its effect.

As we saw three years ago, the amount of income tax withheld from an employee claiming Single with One allowance or Married with One allowance has steadily decreased, with the exception of 2009 where there was a sharp decrease that eventually returned to its pre-depression state two years later. In 1988, an employee would have $81 of federal income tax withheld, based on $500 in income. In 2019, the amount is only $38, but what about the new form that is not based on Allowances?

For the 2020 or newer W-4 form, since there is no such thing as Allowances, I went with a form where the only selection made was to the filing status. In place of Single on the old form, I used Single or Married filing separately, and in place of Married, I used Married filing jointly or Qualifying widow(er). The result is a significant reduction in withholding.

Completing the 2020 W-4 as Single, with no other amounts on any line, results in $28 of federal income tax withheld. This is a 26% reduction in withholding. Selecting Married instead, results in only $2 of federal income tax, which is an 89% reduction.

That is a significant decrease in income tax withheld for one using the new form. The question is will the employee owe taxes when they file their 1040 after the end of the year? The best way to ensure that withholding is accurate and in line with what will be due on the tax return is to perform an IRS Paycheck Checkup at https://www.irs.gov/paycheck-checkup To have just the right amount of tax withheld, use the Tax Withholding Estimator to answer a few questions, and the IRS will let you know how to properly complete the new W-4 form.

While I make every attempt to ensure the accuracy and reliability of the information provided in this article, the information is provided “as-is” without warranty of any kind. PayMaster, Inc. and Romeo Chicco do not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained. Consult with your CPA, Attorney, and/or HR Professional.

[…] year. For more details on why withholding is low, check out this article from two years ago Withholding Tax Drops Drastically, or have your employee check out my video on how to properly complete Form W-4 on […]

[…] year. For more details on why withholding is low, check out this article from two years ago Withholding Tax Drops Drastically, or have your employee check out my video on how to properly complete Form W-4 […]

[…] year. For more details on why withholding is low, check out this article from two years ago Withholding Tax Drops Drastically, or have your employee check out my video on how to properly complete Form W-4 […]