The last time I wrote about Social Security Numbers (SSNs) over four years ago, it was a fun and educational piece about the history of the SSN. You can check it out at this link: https://blog.paymaster.com/a-history-and-education-about-the-ssn/

These days, the SSN has become more important than ever, and it is of utmost importance to get it right. Of course, you should always get the SSN right for compliance with the Department of Homeland Security and the IRS, but that does not always happen.

The filing of state employment and unemployment taxes has become more sophisticated over the recent years by utilizing new technology to ensure more accuracy and efficiency, as well as to fight fraud. Back in the old days, one could complete a state unemployment tax return by hand, stick a stamp on it and mail it off to the state with a check. The agent at the other end may end up scanning it with an optical character recognition (OCR), or they may have entered the numbers by hand. Certainly not accurate or efficient. It could also take them many months to process the quarterly tax return and during that time, there could have been unemployment claims made by employees during that time of processing.

Fast forward to today and most every state mandates electronic filing in some way. A few will allow very small clients to file on paper, but will penalize or flat out reject a larger company that does not get filed electronically. Here is where the SSN becomes of utmost importance. If a person is being reported on a state unemployment tax return, then their logic is that it must be an employee who is eligible to perform work; therefore, there must be a valid SSN issued. If an electronic filing is made with a SSN that is invalid, they will either rejects the file in its entirety or assess a penalty. If the state reject the filing, that means the number needs to be corrected before it can be transmitted again, leading to the possibility of late filing penalties if it takes too long to obtain a correct number. States, such as Florida, will assess a penalty for filing an erroneous, incomplete or insufficient report (which includes an inaccurate SSN) in the amount of $50 or 10% of any tax due, whichever is greater, but no more than $300 per report. That means you can be assessed $300 each and every quarter for a single SSN being invalid.

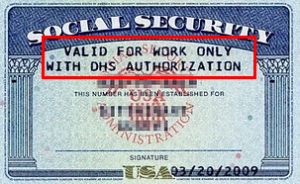

The most common of the invalid SSNs is one that many think is valid. It is the SSN that starts with the number 9. Just because the worker presents a Social Security card, DOES NOT mean they are eligible to perform work. It may state as much, right on the face of the card, as shown in the following example: A number that starts with a 9 is considered a Taxpayer Identification Number (TIN) and allows them to file an income tax return with the IRS, but not perform work as an employee.

Other invalid numbers that would get rejected are…

No SSNs will begin with the number 000 or the ‘number of the beast’ 666 (oh my!)

No SSNs will contain 00 as the Group (two digits in the middle)

No SSNs will contain 0000 as the Series (last four digits)

While a simple SSN verification with SSA would identify an invalid number, it would not catch someone ineligible to work. To ensure that you receive an accurate AND eligible to work SSN when hiring a worker, and to avoid these state filing issues and potential penalties, you can utilize E-Verify. Here is another past article that covers the topic: https://blog.paymaster.com/e-verify-do-you-know-who-you-hire/ If you choose not to use one of these methods, then please be sure you are performing your due diligence and common sense when reviewing employee documents. The last thing we want to see is you assessed a penalty.

Sign up for our monthly newsletter and keep current with all of our timely and important news.

While I make every attempt to ensure the accuracy and reliability of the information provided in this article, the information is provided “as-is” without warranty of any kind. PayMaster, Inc or Romeo Chicco does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained. Consult with your CPA, Attorney, and/or HR Professional as federal, state, and local laws change frequently.

Update May 25, 2022 – The Department of Justice has issued a final rule that revises civil penalties for the hiring of a noncitizen worker that is not authorized for work in the United States. An employer found to have knowingly hired or continues to employ a noncitizen who is not authorized to work in the US will be subject to an order to cease and desist from the unlawful behavior and civil fine. Penalty for first offense for each unauthorized alien: $627 – $5,016, second offense $5,016 – $12,537, and third offense $7,523 – $25,076.