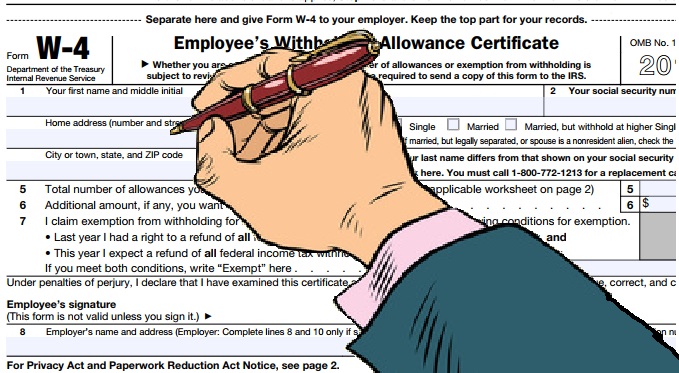

If you are like me, you have been at the edge of your seat waiting for the IRS to release the 2018 Form W-4, Employee Withholding Allowance Certificate since January 1st. Well, on February 28th the wait ended, and here is the new form in all four pages of glory. Yes, four pages. Double the prior year’s 1 page front and back form. At the end of the day, the certificate itself is still just a 1/3 of the first page where the employee will basically indicate whether they are withholding at Single, Married, or Married, but withhold at the higher…

Posts published in “Withholding”

With the recent passing of the new tax law, we will find a significant delay in the IRS’ publishing of the 2018 W-4 Withholding Allowance Form. In the meantime, anyone hired in 2018 should complete the 2017 form, and they will not need to complete the 2018 form when it is released. Unless that is, if they want to later change their withholding. A Form W-4 remains in effect until the employee gives you a new one. When you receive a new form, begin withholding no later than the start of the first payroll period ending on or after the 30th…

While there are many factors to consider when hiring family members, there may be a few advantages from the payroll tax perspective. But, only if you are aware and perform the necessary overrides in your payroll system or notify your payroll service provider. Let’s break this down into the types of family relationships as the advantages are different for each. Parent employs Child – If the child is under the age of 18 and works in their parents business, their wages are not subject to Social Security (OASDI) or Medicare taxes This only if the business is setup a sole proprietorship…

The death of an employee is a difficult time for any business. Grieving co-workers, loss of productivity, and finding and training a replacement are just a few of the factors a business will need to deal with, but one area that is often mishandled is the treatment of wages and payroll. How payroll is handled is all about timing, and I can break it down into three distinct parts. Part 1 – Wages earned and paid prior to the death For wages paid to the employee prior to the death, where the payroll check remains uncashed, a stop payment should…

Reciprocal agreements relieve employees who work and live in different states from the double burden of paying taxes in both states, requiring payment only to their home state. If any of your employees are subject to reciprocal agreements, you can help them out by withholding income tax for their state of residency. How Reciprocal Agreements Work Many states that impose an income tax have entered into reciprocal agreements. For example, Kentucky has reciprocal agreements with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin. Residents of any of those states working in Kentucky are exempt from Kentucky income tax, and would pay and file income…