According to a 2017 study by CareerBuilder, they determined that 78% of US workers live paycheck-to-paycheck and 75% of workers were in debt. With those statistics, many employers find it common to be approached by an employee for a loan or advance. While it may be seen as a way to improve employee morale, productivity, and employee loyalty, there are many other factors to take into consideration to avoid a detrimental impact. In this article, I will cover some of the little known aspects of employee loans and advances. First off is whether or not the loan is going to…

Posts published in “W-2”

The time is here. As a followup to my July 26th, 2018 article, the Social Security Administration has started mailing those Employer Correction Request Notices (EDCOR) to employers who submitted their 2018 W-2 form containing employees names and Social Security Numbers that did not match the SSA’s records. A sample of the notice is provided here. Since this notice is being sent to an employer with just one error, this will affect a large amount of businesses that it may take them several months to send out all of the notices. If you do not see one right away, it…

Over the next few weeks, as your employees start to receive their 2018 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…

A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

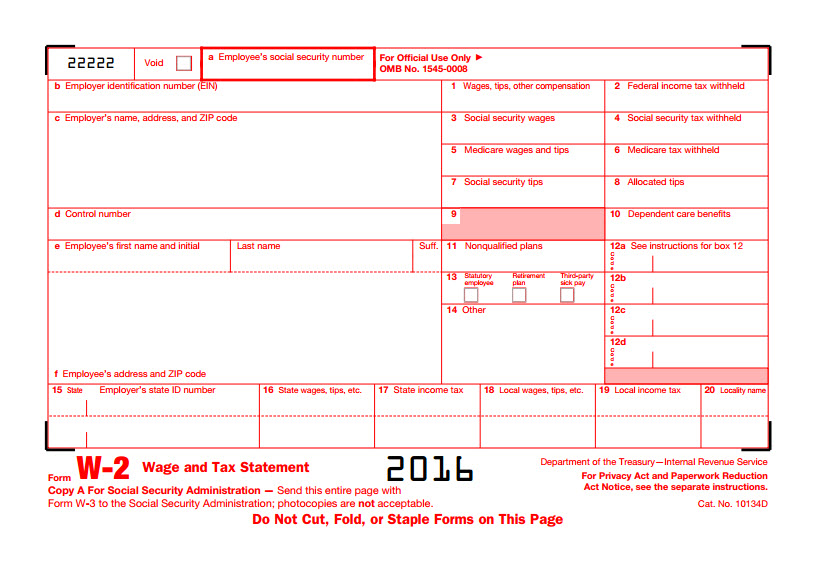

Over the next few weeks as your employees start to receive their 2017 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…

While one should always be vigilant about suspicious emails, this time of the year I recommend an even heightened scrutiny. It is not uncommon to receive requests this time of the year from employees who have not received or lost their W-2 form, and in the old days, this request came in person. Nowadays, it is not uncommon to receive a request via email that you may fulfill via replying. It certainly cuts down on the time that it used to take to find the employer’s hard copy, photo copy the copy, and mail the copy to the employee. …

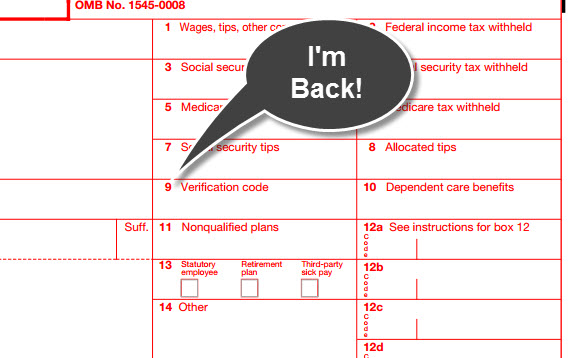

Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…

Over the next few weeks as employees start to receive their 2016 W-2 form, they may likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pretax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what all of…

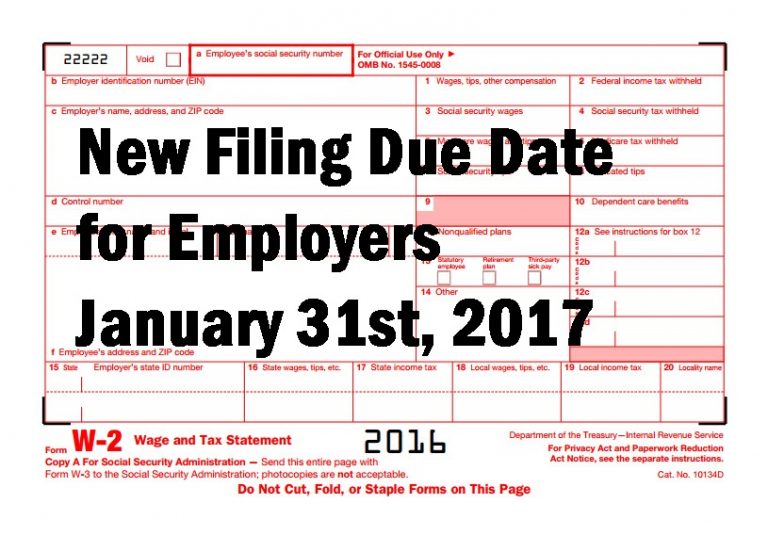

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…