With the recent passing of the new tax law, we will find a significant delay in the IRS’ publishing of the 2018 W-4 Withholding Allowance Form. In the meantime, anyone hired in 2018 should complete the 2017 form, and they will not need to complete the 2018 form when it is released. Unless that is, if they want to later change their withholding. A Form W-4 remains in effect until the employee gives you a new one. When you receive a new form, begin withholding no later than the start of the first payroll period ending on or after the 30th…

Posts published in “Tax”

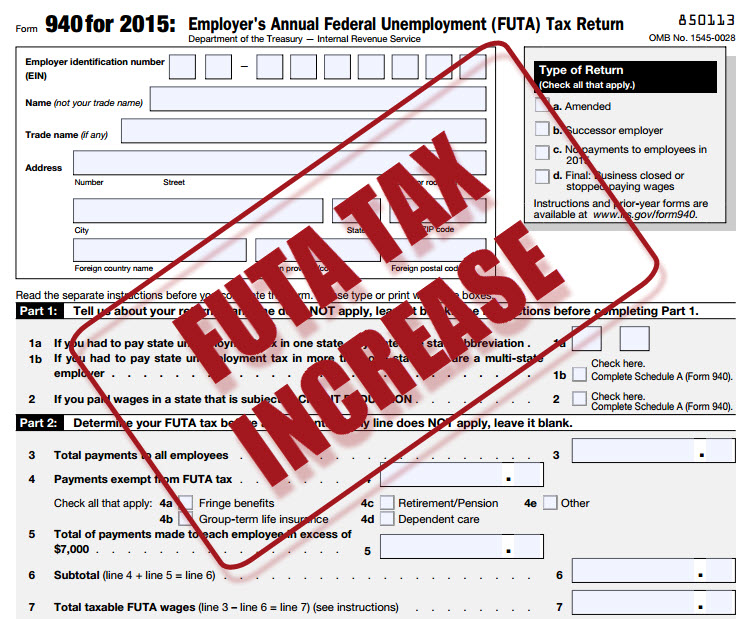

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

This past week, September 29th, President Trump signed into law the Disaster Tax Relief and Airport and Airway Extension Act of 2017. In addition to allowing early withdrawals and loans from retirement plans, deductions for casualty losses, and other personal tax considerations, there is an employment related tax credit for employers (Sec. 503) for retaining their employees during one of the three recent hurricanes; Harvey, Irma, and Maria. Qualifying businesses with locations in one of the Federal declared disaster areas can claim a tax credit for continuing to pay their employees during the time that the business was inoperable until…

Under regulations of Section 125 of the Internal Revenue Code, an employer can implement various Plans which allows employees an opportunity to receive certain benefits on a pre-tax basis. In this article, we will look at the Premium Only Plan (POP), where employees can elect to pay their portion of insurance premiums on a pre-tax basis, creating a savings for both the employee and the employer. Setting up a POP is simple and you just need to have a Plan Document and Summary Plan Description in place that describes all benefits and establishes the rules for eligibility and elections. (If…

While there are many factors to consider when hiring family members, there may be a few advantages from the payroll tax perspective. But, only if you are aware and perform the necessary overrides in your payroll system or notify your payroll service provider. Let’s break this down into the types of family relationships as the advantages are different for each. Parent employs Child – If the child is under the age of 18 and works in their parents business, their wages are not subject to Social Security (OASDI) or Medicare taxes This only if the business is setup a sole proprietorship…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

While one should always be vigilant about suspicious emails, this time of the year I recommend an even heightened scrutiny. It is not uncommon to receive requests this time of the year from employees who have not received or lost their W-2 form, and in the old days, this request came in person. Nowadays, it is not uncommon to receive a request via email that you may fulfill via replying. It certainly cuts down on the time that it used to take to find the employer’s hard copy, photo copy the copy, and mail the copy to the employee. …

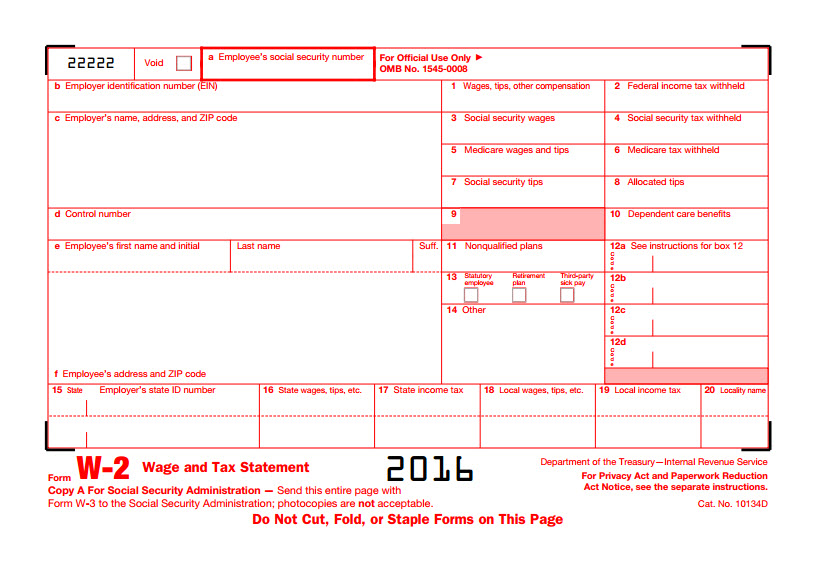

Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…

Over the next few weeks as employees start to receive their 2016 W-2 form, they may likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pretax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what all of…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…