With the exception of four states (Alabama, Florida, Georgia, and Mississippi), each state has specific laws regarding the issuance of a final paycheck to a separated employee. Many states differentiate whether the employee was separated voluntarily or involuntarily, and the timing ranges from “immediately” (yes, this means the same day the employee is terminated) to the next scheduled payday, so I have put together this table for quick and easy reference. Each state has penalties for violation of the final check rule, so be sure you know what is required. A state such as California will enforce the employer to…

Posts published in “FLSA”

A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

While the Federal minimum wage remains at $7.25 per hour, 18 states and many cities/locals have set increases effective January 1st, 2018. A list of each state/local, along with the new hourly rate, and a link to the states determination letter or web page is listed below; Alaska: $9.84 an hour Albuquerque, New Mexico: $8.95 Arizona: $10.50 Bernalillo County, New Mexico: $8.85 California: $11.00 for businesses with 26 or more employees; $10.50 for businesses with 25 or fewer employees Colorado: $10.20 Cupertino, California: $13.50 El Cerrito, California: $13.60 Flagstaff, Arizona: $11.00 Florida: $8.25 Hawaii: $10.10 Los Altos, California: $13.50 Maine: $10.00 Michigan: $9.25 Milpitas, California: $12.00 Minneapolis, Minnesota: $10.00 for businesses with more than 100 employees Minnesota: $9.65 for businesses with…

Not knowing the difference could result in a costly Department of Labor claim. Maybe more costly than a divorce. If your employee is Engaged to Wait then that time is considered hours worked. Conversely, Waiting to be Engaged are off-the-clock hours, thus not hours worked or compensable under the Fair Labor Standards Act (FLSA). So what is the difference between the two? I am glad you asked. Engaged to Wait is time spent primarily for the benefit of the employer, and how much restraint is placed on an employee who is waiting. Let’s look at a few examples to…

Compensatory time, aka Comp Time, has been an acceptable practice for government employees, but a recent bill passed by the House on May 2nd moves on to the Senate. Comp time is formally defined as time off that is accrued by an employee in exchange for cash overtime pay, or more precisely as 1.5 hours of Comp time in exchange for 1 hour worked of overtime. While this may be happening in private businesses today, it is currently a violation of the Fair Labor Standards Act (FLSA), and the Working Families Flexibility Act of 2017 (H.R. 1180) is looking…

Yes you do! Whether you have just one employee, the organization is a sole proprietor or corporation, nonprofit or for-profit, there are posting requirements (for every worksite) that must be complied with, otherwise the employer will face some fairly hefty penalties should there be a check. There is also exposure to employee lawsuits which can be more costly than any government agency fine. These days compliance is very easy. Many office supply stores or even online, sell “all in one” posters, but beware as they are not all created equally and you want to make sure you are covered.…

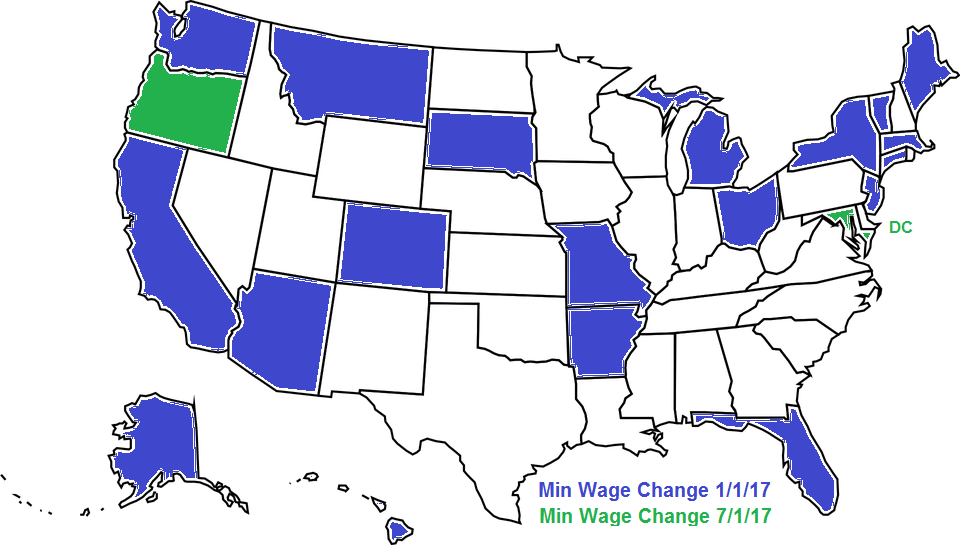

Happy New Year! With the new year comes 19 states changing their minimum wage effective January 1st, and another three states implementing a change effective July 1st. While the federal minimum wage remains the same at $7.25 per hour, the minimum wage for federal contractors has increased to $10.20 per hour. The following states will have a minimum wage change effective January 1st; (click on the state name for additional information) Alaska 9.80 Arizona 10.00 Arkansas 8.50 California 10.50 Colorado 9.30 Connecticut 10.10 Florida 8.10 Hawaii 9.25 Maine 9.00 10.68 Portland Massachusetts 11.00 Michigan 8.90 Missouri 7.70 Montana 8.15…

A federal Judge on Tuesday blocked the law that was passed on May 17th, 2016 to increase the minimum salary amount a worker can earn and remain exempt from overtime pay. U.S. District Judge Amos Mazzant, of Texas, agreed with 21 states and a coalition of business groups, including the U.S. Chamber of Commerce, that the rule is unlawful and granted their motion for a nationwide injunction. Mazzant stated that the federal law governing overtime does not allow the Labor Department to decide which workers are eligible based on salary levels alone. The rule was to take effect on…

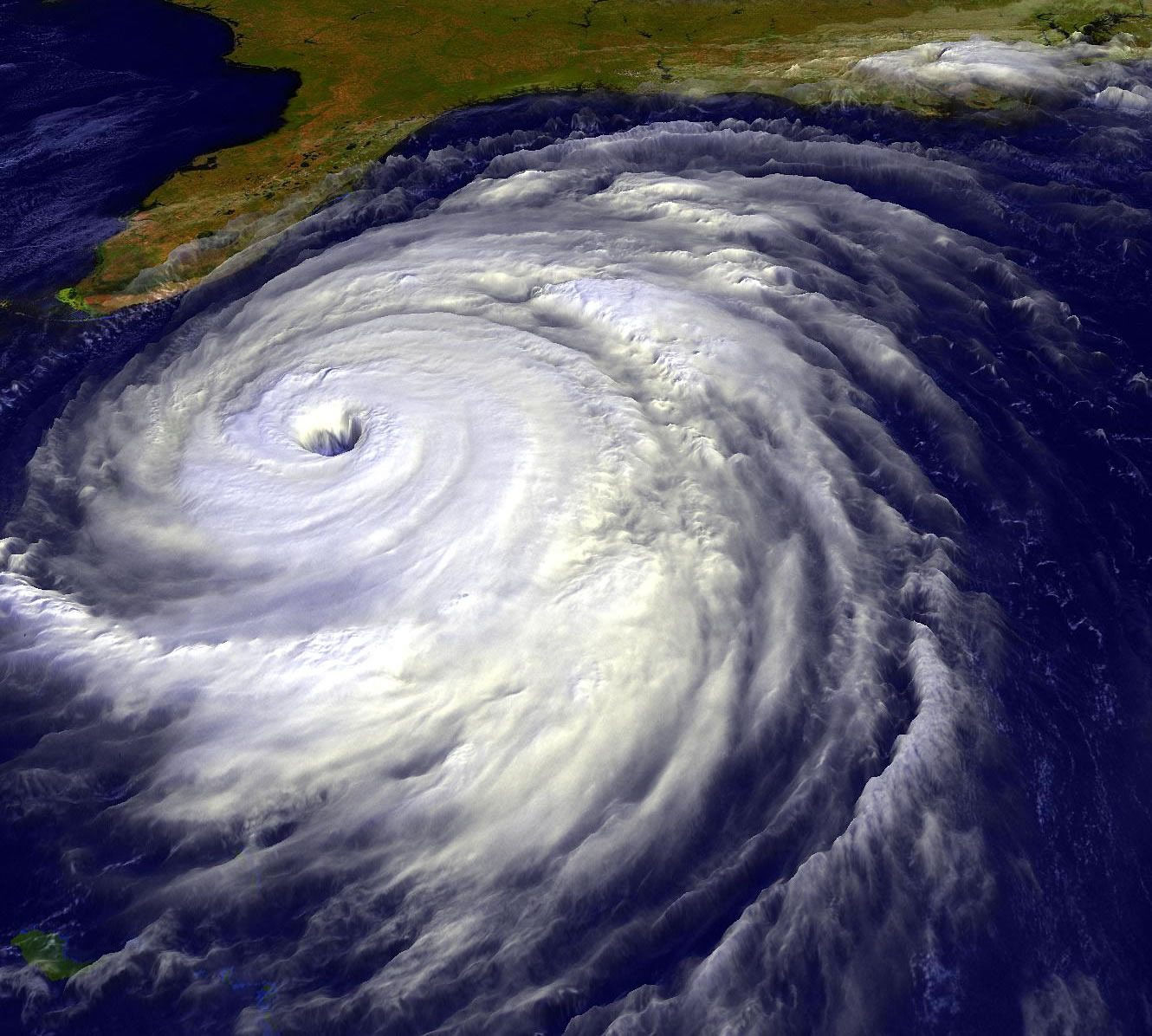

A question that I am frequently asked after a hurricane strikes is “Do I have to pay my employees for times that my business is closed during and after the storm?” The answer is a resounding “maybe”. It all depends upon the classification of employee (and company policy), and we can break it down into two distinct categories; Hourly and Salaried. Let’s look at the hourly employee first. An employee who is paid based on the hours they work would not be entitled to any legally mandated pay for time they are not working. Some states require that if an employee…

I guess you can’t say we did not warn you. One day after our posting of the new Overtime Regulation coming, it is signed into law taking effect on December 1st, 2016. On Tuesday, May 17, 2016, the Department of Labor published its long-awaited final rule updating the Fair Labor Standards Act (FLSA) overtime regulations. The most material changes relate to the minimum salary you must pay to exempt employees, which is discussed in more detail below. For full details, be sure you read the previous article “Are You Ready?” The new regulation increases the salary test to $913 per week ($47,476 year),…