While one should always be vigilant about suspicious emails, this time of the year I recommend an even heightened scrutiny. It is not uncommon to receive requests this time of the year from employees who have not received or lost their W-2 form, and in the old days, this request came in person. Nowadays, it is not uncommon to receive a request via email that you may fulfill via replying. It certainly cuts down on the time that it used to take to find the employer’s hard copy, photo copy the copy, and mail the copy to the employee. …

Posts tagged as “W-2”

Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…

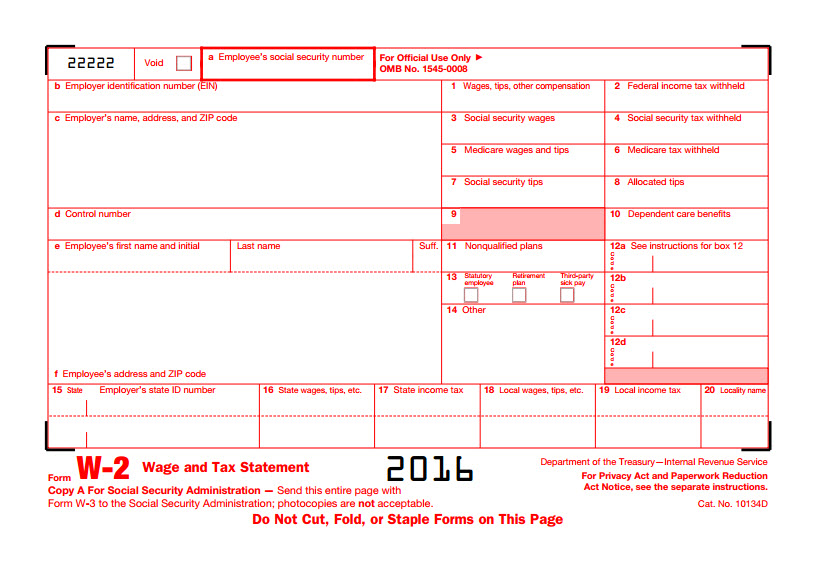

Over the next few weeks as employees start to receive their 2016 W-2 form, they may likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pretax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what all of…

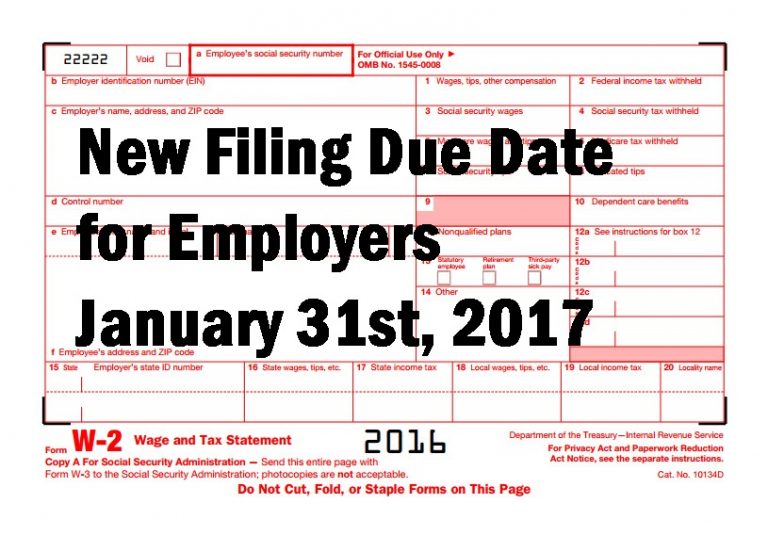

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…