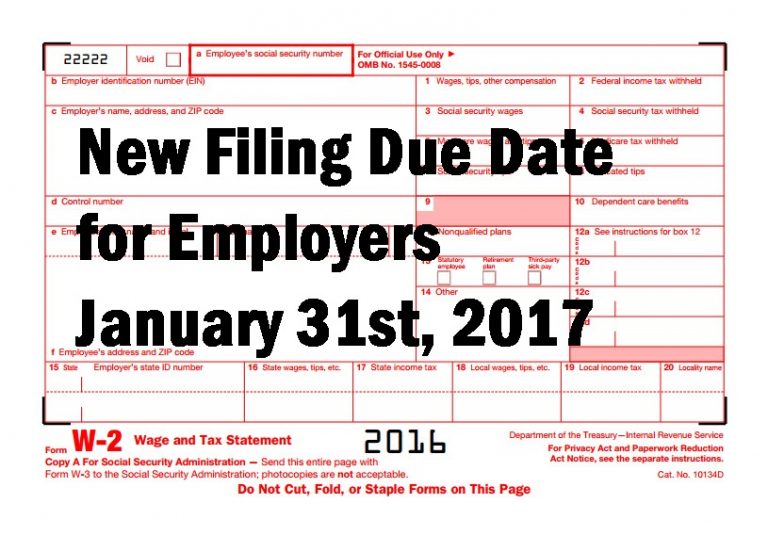

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…