There is a direct correlation between the size of an employer’s workforce and the likeliness of their offering a retirement plan. While about 92% of companies having greater than 10,000 employees offer a 401(k)-style plan, those with under 10 employees, the rate drops to 8%. The flip side is that 86% of employers do not offer a plan, which translates to about 68 million Americans without access to a employer-sponsored plan, and states have taken notice.

Beginning in 2017, a number of states have implemented laws requiring smaller businesses to implement a plan with many more in the legislative proposal stage. As of December 2016, the average monthly Social Security benefit was $1,406.58, and since one is 15 times more likely to save for retirement when a workplace plan is available, this could be the solution for individuals to supplement their retirement income.

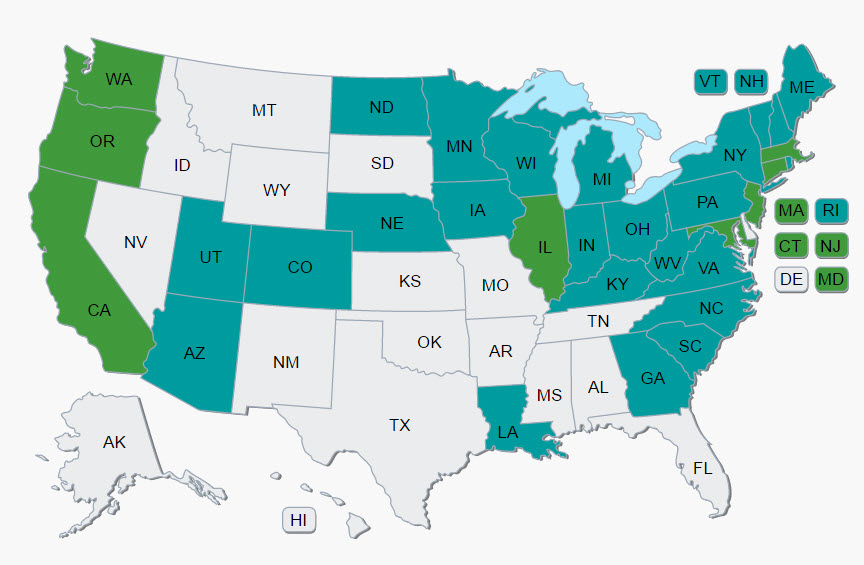

Each green state identified above, and listed below has enacted mandatory retirement plan laws. These laws vary greatly from state to state, so be sure to check with your state to find out what is required. For example, in California, employers with five or more employees are affected, while in Illinois, it is 25 or more employees. The other states identified in the map above are in some stage of proposed legislation/proposal.

Click on each state for details.

If you are PayMaster client, contact our office, as we have a solution with our payroll deducted EZ IRA plan.