Do you own a business in Virginia? Here’s some helpful information and links:

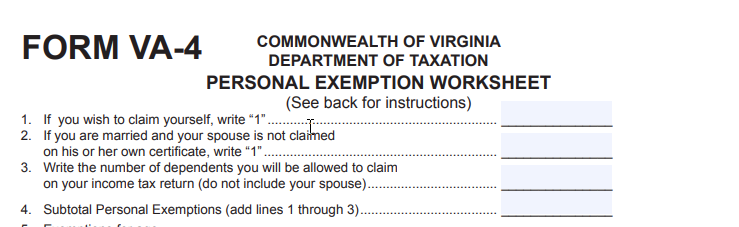

Virginia does have state income tax. Employers should have their employee’s fill out form VA-4.

Additional information regarding Virginia state withholding tax can be found here.

Virginia does have reciprocity agreements with Kentucky, Maryland, Pennsylvania, West Virginia and the District of Columbia.

Employees that live in the District of Columbia and Kentucky that commute to Virginia every day and only receive wage or salary income in Virginia are exempt from taxation in Virginia.

Employees that live in Maryland, Pennsylvania or West Virginia are exempt from taxation in Virginia if: they are taxed in their home state, are present in Virginia 183 days or less during the year, do not maintain an house or apartment in Virginia and receive only wages or salary income in Virginia.

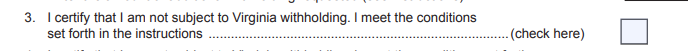

If your employees are exempt from Virginia income tax, they should complete the VA-4 and indicate their exemption on line 3.

For more information on Virginia’s reciprocity agreements click here.