Do you own a business in Pennsylvania? Here’s some helpful information and links.

Pennsylvania has state and local personal income tax. Employers must have their employees fill out the REV-419 form regardless if they live in the state or not.

If the employee lives in Pennsylvania then employers must follow the additional local income tax requirements.

To learn more about the state and local income taxes in Pennsylvania please visit the links below:

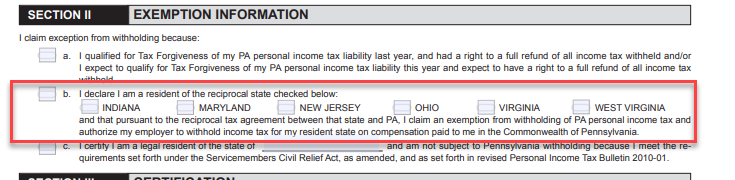

Pennsylvania has income reciprocity agreement with the following states: Indiana, Maryland, New Jersey, Ohio, Virginia and West Virginia.

If your employee lives in one of those states they need to check box B in section II on the REV-419. The employer withholds the income tax of the state in which the nonresident employee resides and pays the tax to that state.

This information can be found on page 10 – 11 in the Employer Withholding Information Guide.