United States Citizenship and Immigration Services (USCIS) Form I-9 is used for verifying the identity and employment authorization of all individuals (citizens and non-citizens) hired for employment. On July 17th USCIS released a new form and employers have 60 days to implement this new version. First introduced in November 1986, this form is completed by both the newly hired Employee (where they state their eligibility to work -Section 1), and the Employer (where they verify the employee’s eligibility -Section 2) within three days of hire. The list of acceptable documents referenced by the employer to verify the employee’s eligibility…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

Compensatory time, aka Comp Time, has been an acceptable practice for government employees, but a recent bill passed by the House on May 2nd moves on to the Senate. Comp time is formally defined as time off that is accrued by an employee in exchange for cash overtime pay, or more precisely as 1.5 hours of Comp time in exchange for 1 hour worked of overtime. While this may be happening in private businesses today, it is currently a violation of the Fair Labor Standards Act (FLSA), and the Working Families Flexibility Act of 2017 (H.R. 1180) is looking…

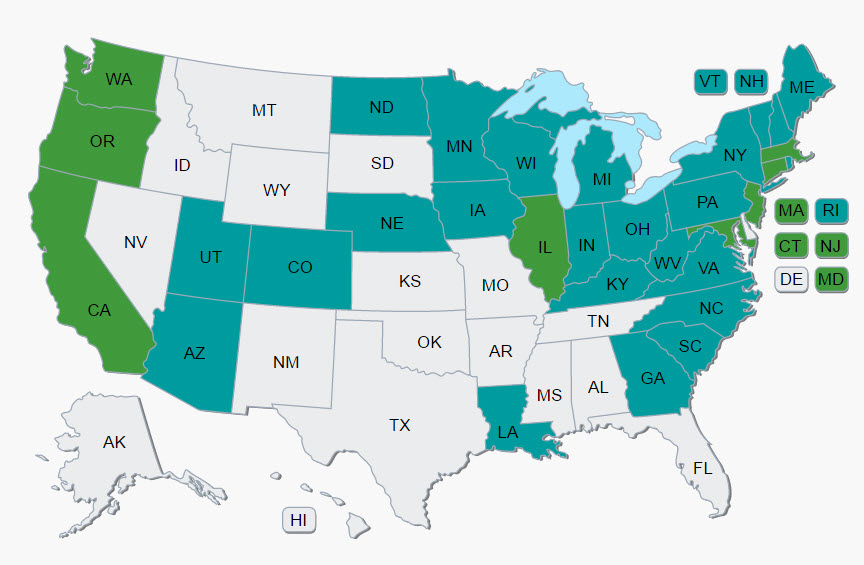

There is a direct correlation between the size of an employer’s workforce and the likeliness of their offering a retirement plan. While about 92% of companies having greater than 10,000 employees offer a 401(k)-style plan, those with under 10 employees, the rate drops to 8%. The flip side is that 86% of employers do not offer a plan, which translates to about 68 million Americans without access to a employer-sponsored plan, and states have taken notice. Beginning in 2017, a number of states have implemented laws requiring smaller businesses to implement a plan with many more in the legislative proposal…

Yes you do! Whether you have just one employee, the organization is a sole proprietor or corporation, nonprofit or for-profit, there are posting requirements (for every worksite) that must be complied with, otherwise the employer will face some fairly hefty penalties should there be a check. There is also exposure to employee lawsuits which can be more costly than any government agency fine. These days compliance is very easy. Many office supply stores or even online, sell “all in one” posters, but beware as they are not all created equally and you want to make sure you are covered.…

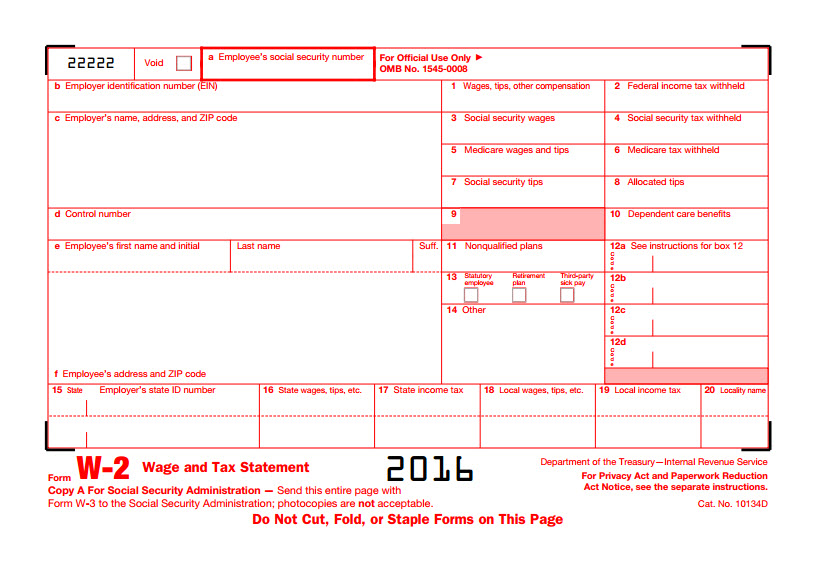

While one should always be vigilant about suspicious emails, this time of the year I recommend an even heightened scrutiny. It is not uncommon to receive requests this time of the year from employees who have not received or lost their W-2 form, and in the old days, this request came in person. Nowadays, it is not uncommon to receive a request via email that you may fulfill via replying. It certainly cuts down on the time that it used to take to find the employer’s hard copy, photo copy the copy, and mail the copy to the employee. …

Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…

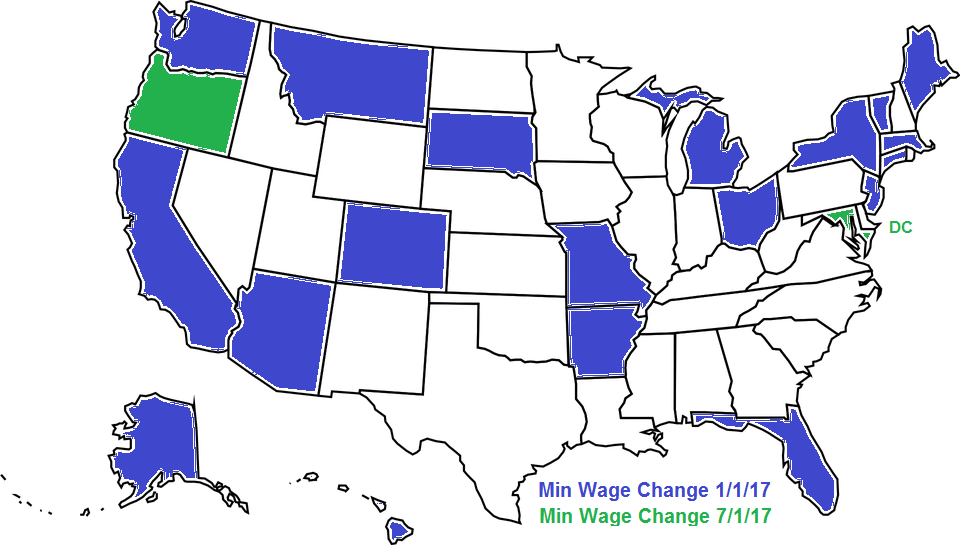

Happy New Year! With the new year comes 19 states changing their minimum wage effective January 1st, and another three states implementing a change effective July 1st. While the federal minimum wage remains the same at $7.25 per hour, the minimum wage for federal contractors has increased to $10.20 per hour. The following states will have a minimum wage change effective January 1st; (click on the state name for additional information) Alaska 9.80 Arizona 10.00 Arkansas 8.50 California 10.50 Colorado 9.30 Connecticut 10.10 Florida 8.10 Hawaii 9.25 Maine 9.00 10.68 Portland Massachusetts 11.00 Michigan 8.90 Missouri 7.70 Montana 8.15…

Over the next few weeks as employees start to receive their 2016 W-2 form, they may likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pretax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what all of…

A federal Judge on Tuesday blocked the law that was passed on May 17th, 2016 to increase the minimum salary amount a worker can earn and remain exempt from overtime pay. U.S. District Judge Amos Mazzant, of Texas, agreed with 21 states and a coalition of business groups, including the U.S. Chamber of Commerce, that the rule is unlawful and granted their motion for a nationwide injunction. Mazzant stated that the federal law governing overtime does not allow the Labor Department to decide which workers are eligible based on salary levels alone. The rule was to take effect on…