The Credit For Portion Of Employer Social Security Paid With Respect To Employee Cash Tips, or Excess FICA Tax Credit on Tips, for short, to be exact. If you are familiar with this tax credit, then congratulations, you are one of the few (just be sure you are not a victim to the ‘Confusions’ I point out below). The IRS recently reported that for tax 2012 (yeah, it takes them this long to report), 66,400 taxpayers took advantage of this credit. This quantity seemed underwhelming to me, so I did some research as to how many businesses were potential candidates. …

We carry health insurance for routine ‘maintenance’ and unforeseen events, auto and home insurance for unexpected property losses, but what about protection and assistance with the day to day situations that could require legal assistance? Review of an agreement or contract ♦ securing a mortgage ♦ collecting or settling a debt ♦ credit report issues ♦ probate ♦ bankruptcy ♦ immigration ♦ divorce ♦ preparing a will ♦ traffic citation ♦ marriage ♦ purchasing faulty merchandise/consumer protection ♦ notary services ♦ these are all situations where having an attorney would be of great value, but sometimes the cost can be discouraging from having the much needed legal assistance. Studies have shown that 7 out of 10 people have experienced some sort of legal event in…

When the Tax Cuts and Jobs Act was signed into law back in December 2017, it included Section 45S to the IRS Code which includes a credit for employers who pay for family and medical leave. The credit is a percentage of the amount of wages paid to a qualifying employee while on leave for up to 12 weeks per taxable year. The minimum percentage is 12.5% and is increased by .25% for each percentage point by which the amount paid to a qualifying employee exceeds 50% of the employee’s wages, with a maximum credit of 25% (for employers that…

A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

E-Verify started as a pilot program in 1997 to help employers verify the work authorization of new hires. When you have an employee complete a USCIS Form I-9, you are taking the word of the employee and the face value of the documents they provide. E-Verify allows you to confirm the provided documentation against multiple government databases. All employers must first complete an I-9 form for every new hire, within three business days of the date the employee starts work. Employers must not begin the I-9 process until after the individual is hired. The newly-hired employee jointly completes the I-9 form…

All private employers, even Old MacDonald, who are subject to Title VII of the Civil Rights Act of 1964 (as amended by the EEO Act of 1972) with 100 or more employees and have establishments located in the 50 states or DC are required to file the Standard Form 100 (aka EEO-1) on or before March 31st of each year. This includes state and local governments, primary and secondary school systems, institutions of higher education, Indian tribes, and tax-exempt private membership clubs other than labor organizations. Companies with centralized ownership, control, or management count all employees across all organizations to…

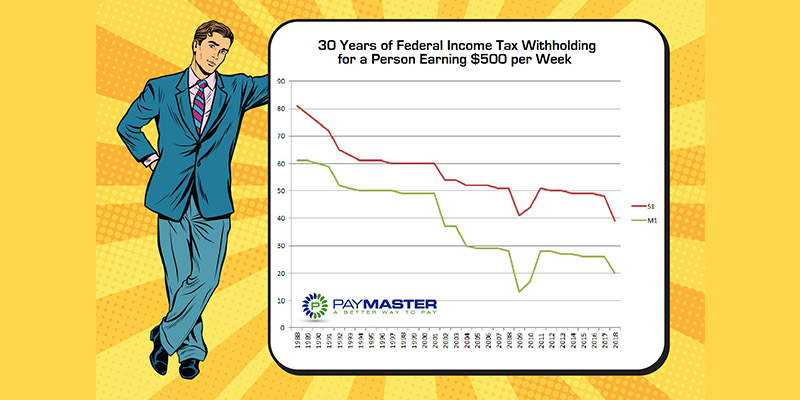

If you are like me, you have been at the edge of your seat waiting for the IRS to release the 2018 Form W-4, Employee Withholding Allowance Certificate since January 1st. Well, on February 28th the wait ended, and here is the new form in all four pages of glory. Yes, four pages. Double the prior year’s 1 page front and back form. At the end of the day, the certificate itself is still just a 1/3 of the first page where the employee will basically indicate whether they are withholding at Single, Married, or Married, but withhold at the higher…

Because background screenings are closely regulated by the Fair Credit Reporting Act (FCRA), it’s important to ensure compliance. One of the most common screening mistakes employers make is not providing a legally mandated disclosure to candidate and obtaining written consent to conduct a background check. Many companies have suffered costly lawsuits for not complying with these requirements. If an employer fails to meet FCRA requirements, applicants can allege statutory FCRA violations without suffering damages. If an employer is found in violation of FCRA requirements, each applicant not provided the disclosure form may seek recovery, frequently through Class Action lawsuits. Additionally,…

Over the next few weeks as your employees start to receive their 2017 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…