Over two decades ago, as a result of 9/11, President G.W. Bush signed the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (The PATRIOT) Act of 2001 into law. One purpose of the PATRIOT Act is to deter and punish terrorist acts in the United States and around the world by putting in measures to prevent, detect and prosecute money laundering and financial terrorism. One may ask themselves, what does this have to do with payroll? Plenty.

The Act states that all individuals and organizations within the United States are responsible for ensuring that they do not undertake business dealings with an individual or entity listed on a terrorist watch list. The U.S. Treasury’s Office of Foreign Assets Control (OFAC) publishes this list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. The list also includes individuals, groups and entities, such as terrorists and narcotics traffickers designated under programs that are not country-specific. “All individuals,” by definition, includes employers, therefore, checking the list for your employees is not specifically mandated; hiring someone on the list is prohibited.

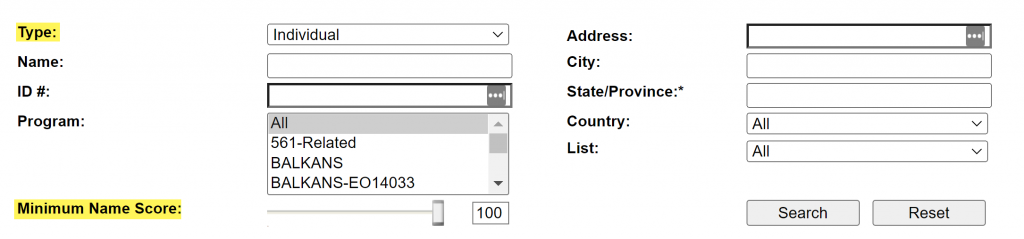

Searching the list is easy and there is not any pre-requisite/registration required. Simply go to the OFAC sanctions website https://sanctionssearch.ofac.treas.gov/ and perform your search. On the search screen, you should change the Type to “Individual,” so you are not searching names of vessels, aircraft and entities, type in the employee name in the Name field and search. As a good measure, document your search and keep the, hopefully negative, search results in the employee’s file.

There is a Minimum Name Score slider and when set to 100 (the default), it will look for an exact match of the name. Moving that slider can also provide a broader set of results using fuzzy logic. This logic uses character and string matching as well as phonetic matching. Only the name field of Search invokes fuzzy logic when the search is run.

What if your search comes up with a match? Don’t panic. It does not necessarily mean the employee is, in fact, a terrorist. OFAC provides an interactive “due diligence” at the following web link to let you know if you need to call the government and to which office. https://home.treasury.gov/policy-issues/financial-sanctions/contact-ofac/when-should-i-call-the-ofac-hotline

OFAC treats violations as a serious threat to national security and foreign relations. As a result, offenders face monetary fines ranging from a few thousand dollars to several million and prison time up to 30 years. In 2019, OFAC penalized businesses and individuals over $1.2 billion, with the past couple of years averaging just over $20 million each year.

In summary, getting it right to ensure you have a positive match and taking appropriate action is extremely important. A false positive, and you may unfairly deny employment to an innocent individual and possibly face discrimination and other civil liberty claims. On the other hand, hiring an employee who is on the list could put you in violation of OFAC and subject to huge fines and possible jail time.

Sign up for our monthly newsletter and keep current with all of our timely and important news.