A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

Posts published in “Uncategorized”

E-Verify started as a pilot program in 1997 to help employers verify the work authorization of new hires. When you have an employee complete a USCIS Form I-9, you are taking the word of the employee and the face value of the documents they provide. E-Verify allows you to confirm the provided documentation against multiple government databases. All employers must first complete an I-9 form for every new hire, within three business days of the date the employee starts work. Employers must not begin the I-9 process until after the individual is hired. The newly-hired employee jointly completes the I-9 form…

All private employers, even Old MacDonald, who are subject to Title VII of the Civil Rights Act of 1964 (as amended by the EEO Act of 1972) with 100 or more employees and have establishments located in the 50 states or DC are required to file the Standard Form 100 (aka EEO-1) on or before March 31st of each year. This includes state and local governments, primary and secondary school systems, institutions of higher education, Indian tribes, and tax-exempt private membership clubs other than labor organizations. Companies with centralized ownership, control, or management count all employees across all organizations to…

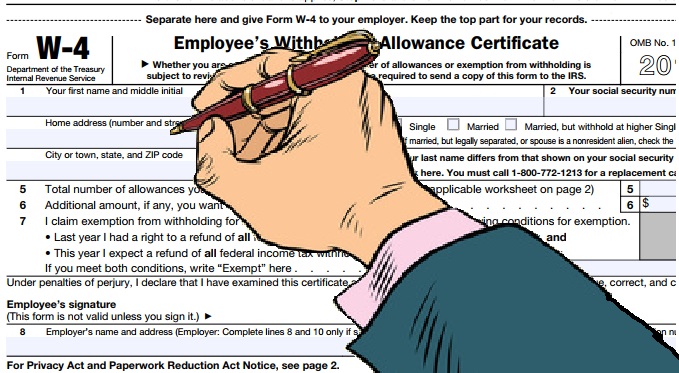

If you are like me, you have been at the edge of your seat waiting for the IRS to release the 2018 Form W-4, Employee Withholding Allowance Certificate since January 1st. Well, on February 28th the wait ended, and here is the new form in all four pages of glory. Yes, four pages. Double the prior year’s 1 page front and back form. At the end of the day, the certificate itself is still just a 1/3 of the first page where the employee will basically indicate whether they are withholding at Single, Married, or Married, but withhold at the higher…

Because background screenings are closely regulated by the Fair Credit Reporting Act (FCRA), it’s important to ensure compliance. One of the most common screening mistakes employers make is not providing a legally mandated disclosure to candidate and obtaining written consent to conduct a background check. Many companies have suffered costly lawsuits for not complying with these requirements. If an employer fails to meet FCRA requirements, applicants can allege statutory FCRA violations without suffering damages. If an employer is found in violation of FCRA requirements, each applicant not provided the disclosure form may seek recovery, frequently through Class Action lawsuits. Additionally,…

Over the next few weeks as your employees start to receive their 2017 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…

While the Federal minimum wage remains at $7.25 per hour, 18 states and many cities/locals have set increases effective January 1st, 2018. A list of each state/local, along with the new hourly rate, and a link to the states determination letter or web page is listed below; Alaska: $9.84 an hour Albuquerque, New Mexico: $8.95 Arizona: $10.50 Bernalillo County, New Mexico: $8.85 California: $11.00 for businesses with 26 or more employees; $10.50 for businesses with 25 or fewer employees Colorado: $10.20 Cupertino, California: $13.50 El Cerrito, California: $13.60 Flagstaff, Arizona: $11.00 Florida: $8.25 Hawaii: $10.10 Los Altos, California: $13.50 Maine: $10.00 Michigan: $9.25 Milpitas, California: $12.00 Minneapolis, Minnesota: $10.00 for businesses with more than 100 employees Minnesota: $9.65 for businesses with…

With the recent passing of the new tax law, we will find a significant delay in the IRS’ publishing of the 2018 W-4 Withholding Allowance Form. In the meantime, anyone hired in 2018 should complete the 2017 form, and they will not need to complete the 2018 form when it is released. Unless that is, if they want to later change their withholding. A Form W-4 remains in effect until the employee gives you a new one. When you receive a new form, begin withholding no later than the start of the first payroll period ending on or after the 30th…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…