While I do not necessarily write about benefits for individuals, this one happens to affect the employer, or should I say, their previous employer, which could be you. The ARP Act allows involuntarily terminated employees under Subtitle F – Preserving Health Benefits For Workers to receive premium assistance on their COBRA. The premium assistance is in the form of 100% paid for health insurance for the separated employee and their dependents for the coverage period beginning April 1 to September 30, 2021. Newly terminated employees just entering eligibility for COBRA are eligible for the premium assistance, as well as those…

Posts published in “Tax”

I have not been asked about this topic in my previous 25 years, yet in the past few months, I have received at least half a dozen inquiries. I am not sure of the reason this has become a hot topic lately; maybe it is COVID-19, but here are the details and considerations: Paid time off, whether it is Vacation, Sick, PTO, or whatever a company may call it, is a great benefit to its employees. It is there in the event that the employee cannot, or maybe just does not want to go to work, yet receives their pay…

The Families First Coronavirus Response Act (FFCRA) was the first COVID-19 Act passed by Congress on March 18, 2020. Back then, the belief was that COVID-19 would be a short-lived inconvenience where an employee may need to take a couple weeks off from work, and this Act was to allow them that benefit without cost to the employer. Here we are, a year later, still feeling the effects. The Consolidated Appropriations Act (CAA) 2021, passed on December 27, 2020, extended this federal paid leave until March 31, 2021, and we now find further extension and expansion in the recently-passed American…

If your business was impacted by COVID-19, there is a significant amount of unclaimed money quite possibly waiting for you. The amount is up to $26,000 PER EMPLOYEE. But why have you not heard of this? Back when the CARES Act was signed by the President on March 27, 2020, COVID-19 was expected to be short-lived (remember the “15 Days to Slow the Spread” plan?) thus, the benefits were to provide short-term relief. There were a few different major benefits in that Act, but a business was only able to select one. This included the Paycheck Protection Program (PPP), the…

On December 27, 2020, President Trump signed the Consolidated Appropriations Act, 2021. This is an Act that is signed each year, thus the 2021 suffix, and basically includes the federal government’s budget for 2021. It also includes a large section of COVID-19 related benefits for businesses. The following is a summary of what has passed. It is a bit lengthy of a “summary,” but all good stuff. FFCRA Sick and Family Paid Leave The FFCRA tax credit has been extended through March 31, 2021, although the employer mandate has not been extended. This means that an employer can decide whether or not…

Over the next few weeks, as your employees start to receive their 2020 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. Did they get underpaid? Probably not. If the employee contributes to a pension plan (aka 401(k)) or has pre-tax insurance deductions, then those amounts reduces the “taxable” wage, which is what appears in Box 1. To assist you with questions like that, here is a handy guide…

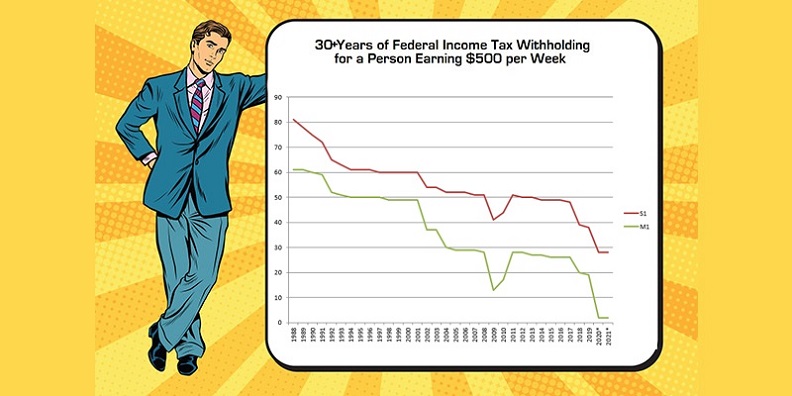

Almost three years ago, I wrote an article about the steady decline in the amount of federal income tax withheld from an employee’s check over the past three decades. This was prior to the new 2020 Form W-4 redesign, so I thought it would be interesting to revisit this chart and see its effect. As we saw three years ago, the amount of income tax withheld from an employee claiming Single with One allowance or Married with One allowance has steadily decreased, with the exception of 2009 where there was a sharp decrease that eventually returned to its pre-depression state…

There has been no change to the 2021 W-4 Form from the recently re-designed 2020 version, other than the tax table, but there has been a bit of confusion. First off, the IRS encourages the use of the new form, but it is not required for 2021. Employees will find a more accurate withholding and, most likely, enjoy a higher net pay on every check if they do complete a new form. Payroll systems that utilize the new tax withholding table have recently been provided the ability to ‘bridge’ the 2019 and earlier form as if they were the the…

Unless you live and work in one of the following nine states that do not tax wages, you are required to withhold state income tax on wages paid to your employees: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. While this may sound simple enough, there are a number of considerations that need to be made, and we will go over them here, including the COVID-19 wrench in the machine. The Form First up is the form itself. There are a few states that did not adopt their own state withholding tax form, so here is…