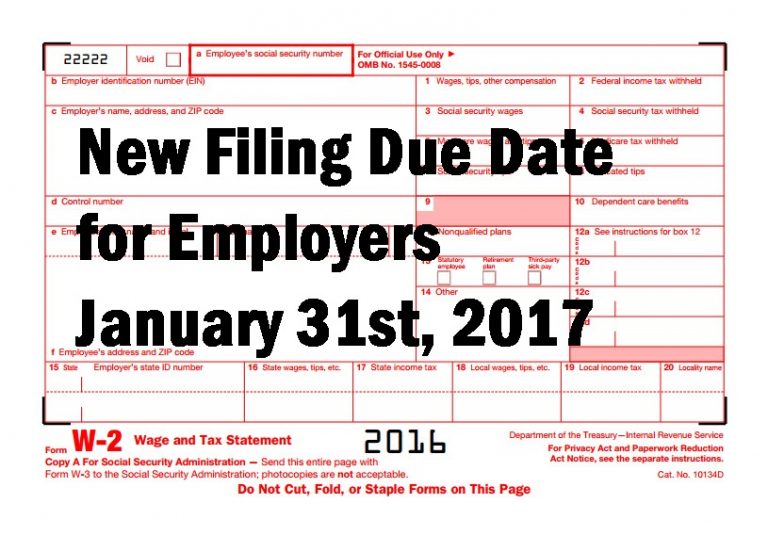

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…

Posts published in “Tax”

The death of an employee is a difficult time for any business. Grieving co-workers, loss of productivity, and finding and training a replacement are just a few of the factors a business will need to deal with, but one area that is often mishandled is the treatment of wages and payroll. How payroll is handled is all about timing, and I can break it down into three distinct parts. Part 1 – Wages earned and paid prior to the death For wages paid to the employee prior to the death, where the payroll check remains uncashed, a stop payment should…

Late last year, Congress passed what is titled the Protecting Americans from Tax Hikes (PATH) Act of 2015. This past week, the IRS issued Notice 2016-22 which provides guidance and Transition Relief for employers claiming the Work Opportunity Tax Credit (WOTC). If you are not familiar with the WOTC, it is a tax incentive for employers to hire and retain individuals from specific target groups. The groups include certain Veterans, Temporary Assistance for Needy Families (TANF) recipients, Food Stamp recipients, Supplemental Security Income (SSI) recipients, Vocational Rehabilitation (VR) Referred Individuals, Ex-Felons, Summer Youth employees, and effective January 1st, 2016, there is…

Reciprocal agreements relieve employees who work and live in different states from the double burden of paying taxes in both states, requiring payment only to their home state. If any of your employees are subject to reciprocal agreements, you can help them out by withholding income tax for their state of residency. How Reciprocal Agreements Work Many states that impose an income tax have entered into reciprocal agreements. For example, Kentucky has reciprocal agreements with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin. Residents of any of those states working in Kentucky are exempt from Kentucky income tax, and would pay and file income…

This time of the year is a popular time to give gift cards to your employees as a way of showing appreciation, but you need to be sure it is reported as wages, and they pay tax on the value. Whether it is a $5 Starbucks card to a $50 gift card at a brand store, or even just a Visa gift card for $X amount, you need to include the full value of the gift in the employee’s taxable wages. The IRS considers gift cards as a cash equivalent, no matter what the value, and it does not fall under their…

On December 18, 2015, President Obama signed the Omnibus Spending Bill H.R. 2029 and the PATH Act (Protecting Americans from Tax Hikes Act of 2015) into law, which among other provisions, provides a five-year extension to the Work Opportunity Tax Credit (WOTC) program, as well as expands its scope of eligible groups. The WOTC is basically a tax incentive for employers to hire and retain individuals from specific target groups. The groups include certain Veterans, Temporary Assistance for Needy Families (TANF) recipients, Food Stamp recipients, Supplemental Security Income (SSI) recipients, Vocational Rehabilitation (VR) Referred Individuals, Ex-Felons, and Summer Youth employees.…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

As 2015 is just starting to wind down, the government has already set many limits for 2016. In general, the limitations will not change as a result of the cost of living index not meeting the statutory thresholds that trigger a change. The Old-Age, Survivors, and Disability Insurance (OASDI), aka Social Security, wage limit remains unchanged at $118,500 and a tax rate of 6.20%. The last time the OASDI wage limit did not increase was between 2009 to 2011 where it remained at $106,800. Prior to 2009, the limit had always increased going all the way back to 1950. The deferral limits for your pension…