With the passage of the Families First Coronavirus Response Act, two new refundable payroll tax credits are available to employers with fewer than 500 employees. These refundable credits are designed to fully reimburse them, dollar-for-dollar, for the cost of providing Coronavirus-related leave to their employees. The Act allows two paid leaves for the employee’s own health needs or the care of family members. This will enable employers to keep their employees on payroll and ensure that employees are not forced to choose between their paycheck and the public wellbeing. Emergency Paid Sick Leave Companies with fewer than 500 employees,…

Posts published in “Tax”

There are times when an employee’s actual gross pay (excluding taxable fringe items) is insufficient to accommodate all of their deductions in full. In those cases where there is not enough net pay, there is an order in which deductions are to be processed until the check is zero. I am going to cover the basics of that order without going into the details of each specific deduction, as this would end up being a super-sized blog. Be sure to check out my previous blogs for details on some of the specific deductions. Deductions are taken in the order below,…

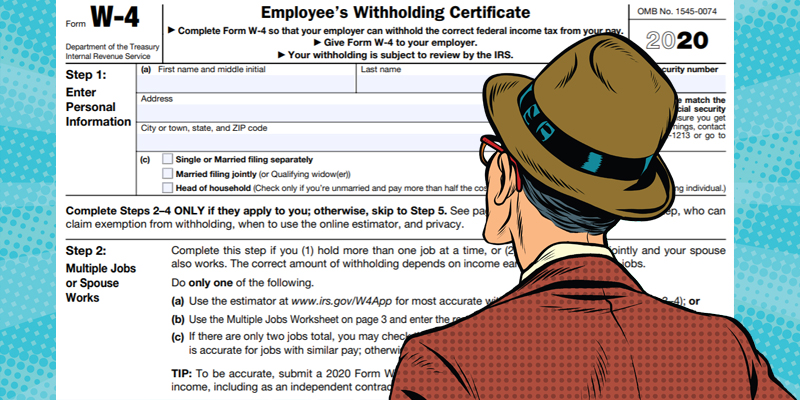

The 2020 Form W-4, Employee’s Withholding Certificate, is very different from previous versions. This is due to the federal tax law changes that took place in 2018 from the 2017 Tax Cuts and Jobs Act. Check out my prior article with a bit of history and nostalgia of a 30 year old form. https://blog.paymaster.com/here-it-comes-2020-w4-form/ The most significant change is that there is no longer the use of withholding allowances, and the form asks the employee to basically prepare an estimated tax return. Some of the information requested may even be considered intrusive, including income from other sources, spouse income, itemized…

Over the next few weeks, as your employees start to receive their 2019 W-2 form, they will most likely have many questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response may be, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with questions like that, here is a handy guide. Download the 2019 W-2…

Employers who operate in more than one state need to understand the complexity of determining the proper state location for reporting unemployment taxes for each employee. In this article, we will cover the rules and factors utilized by all states to report and pay taxes, which we can break down to a four-step process. We will not cover state income tax here. That is a topic in itself and will be covered in a future article. Before we start, let’s cover the simple scenario. Employee lives in Florida, but each day drives and crosses state lines to work in Georgia…

We all know that when we pay an employee in cash/wages, it is a taxable transaction to the employee. What is less commonly known is what should happen when something of value other than cash/wages is given. Gifts such as a Thanksgiving turkey, a $25 store gift card for a job well done, a Caribbean cruise vacation for meeting a sales quota, or even a Rolex watch for an employee’s twenty-year anniversary with the company all have different tax consequences. Sometimes the exact same gift given under two different situations may be taxed differently. This article will cover the…

The W-4 form has remained basically unchanged for many decades. For a flashback, here is what it looked like in 1990: https://www.irs.gov/pub/irs-prior/fw4–1990.pdf. Unchanged until now, that is. The IRS has done a complete revamp of the form for 2020 by adding many additional fields for the employee to complete as well as removing ‘number of allowances.’ You may ask how that can be since the number of allowances basically dictated the amount of federal income tax withheld from a paycheck. You need to see the new form to believe it, and here it is: https://www.irs.gov/pub/irs-dft/fw4–dft.pdf. The form asks the employee…

Ever since the 2015 Obergefell v. Hodges case in which the Supreme Court of the United States ruled that the fundamental right to marry is guaranteed to same-sex couples by both the Due Process Clause and the Equal Protection Clause of the Fourteenth Amendment to the United States Constitution, it has been shown that the number of employers offering domestic partner benefits has significantly decreased. A year before the ruling (2014), a survey reflected that 59% provided benefits to same-sex domestic partners and just one year later (2016), 48% are providing benefits with that number decreasing each year. The reason…

According to a 2017 study by CareerBuilder, they determined that 78% of US workers live paycheck-to-paycheck and 75% of workers were in debt. With those statistics, many employers find it common to be approached by an employee for a loan or advance. While it may be seen as a way to improve employee morale, productivity, and employee loyalty, there are many other factors to take into consideration to avoid a detrimental impact. In this article, I will cover some of the little known aspects of employee loans and advances. First off is whether or not the loan is going to…

The time is here. As a followup to my July 26th, 2018 article, the Social Security Administration has started mailing those Employer Correction Request Notices (EDCOR) to employers who submitted their 2018 W-2 form containing employees names and Social Security Numbers that did not match the SSA’s records. A sample of the notice is provided here. Since this notice is being sent to an employer with just one error, this will affect a large amount of businesses that it may take them several months to send out all of the notices. If you do not see one right away, it…