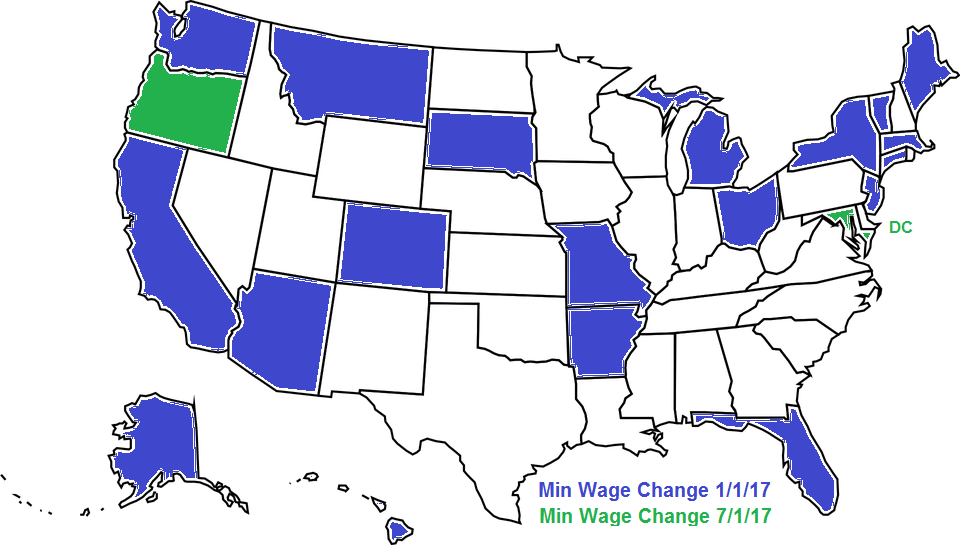

Happy New Year! With the new year comes 19 states changing their minimum wage effective January 1st, and another three states implementing a change effective July 1st. While the federal minimum wage remains the same at $7.25 per hour, the minimum wage for federal contractors has increased to $10.20 per hour. The following states will have a minimum wage change effective January 1st; (click on the state name for additional information) Alaska 9.80 Arizona 10.00 Arkansas 8.50 California 10.50 Colorado 9.30 Connecticut 10.10 Florida 8.10 Hawaii 9.25 Maine 9.00 10.68 Portland Massachusetts 11.00 Michigan 8.90 Missouri 7.70 Montana 8.15…

Posts published in “Payroll”

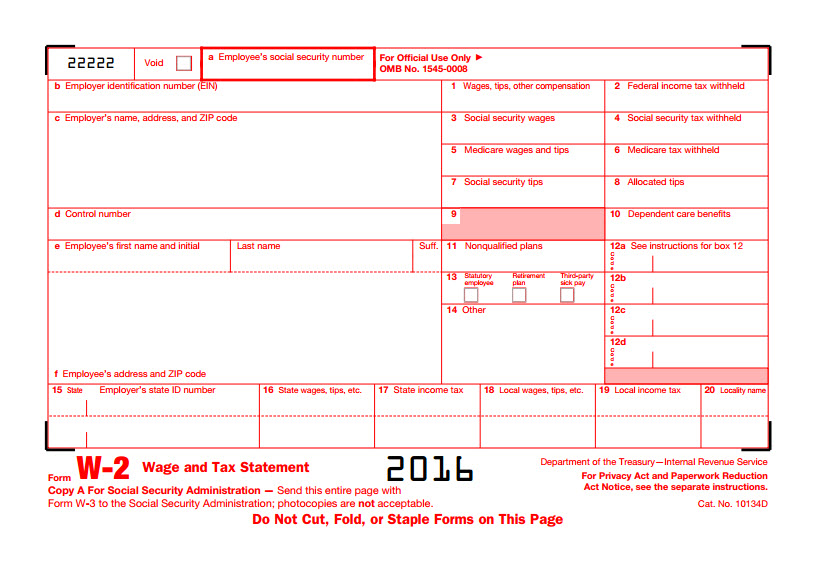

Over the next few weeks as employees start to receive their 2016 W-2 form, they may likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pretax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what all of…

A federal Judge on Tuesday blocked the law that was passed on May 17th, 2016 to increase the minimum salary amount a worker can earn and remain exempt from overtime pay. U.S. District Judge Amos Mazzant, of Texas, agreed with 21 states and a coalition of business groups, including the U.S. Chamber of Commerce, that the rule is unlawful and granted their motion for a nationwide injunction. Mazzant stated that the federal law governing overtime does not allow the Labor Department to decide which workers are eligible based on salary levels alone. The rule was to take effect on…

Yesterday, November 18, the IRS issued Notice 2016-70, which extends the due date for the 2016 requirement to furnish ACA-related statements to individuals for insurers, self-insuring employers, and certain other providers of minimum essential coverage under I.R.C. § 6055, and for applicable large employers under I.R.C. § 6056, and extends good-faith transition relief from section 6721 and 6722 penalties to the 2016 information-reporting requirements under sections 6055 and 6056. The due date is extended from January 31st, 2017 to March 2nd, 2017. The notice also provides guidance to individuals who, as a result of these extensions, might not receive a…

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

Whether you are in a state that has already legalized the use of marijuana (medical or recreational), or you are just waking up to your state passing the legalization last night, you need to consider its impact on your workplace. How does legalized marijuana use come into play in regards to your Zero Tolerance/Drug Free Workplace policy? Are you required to accommodate the use of medical marijuana during an employee’s shift? Does language in your employee handbook conflict with your state’s laws? These are just a few of the questions a business needs to take into serious consideration. For example, some…

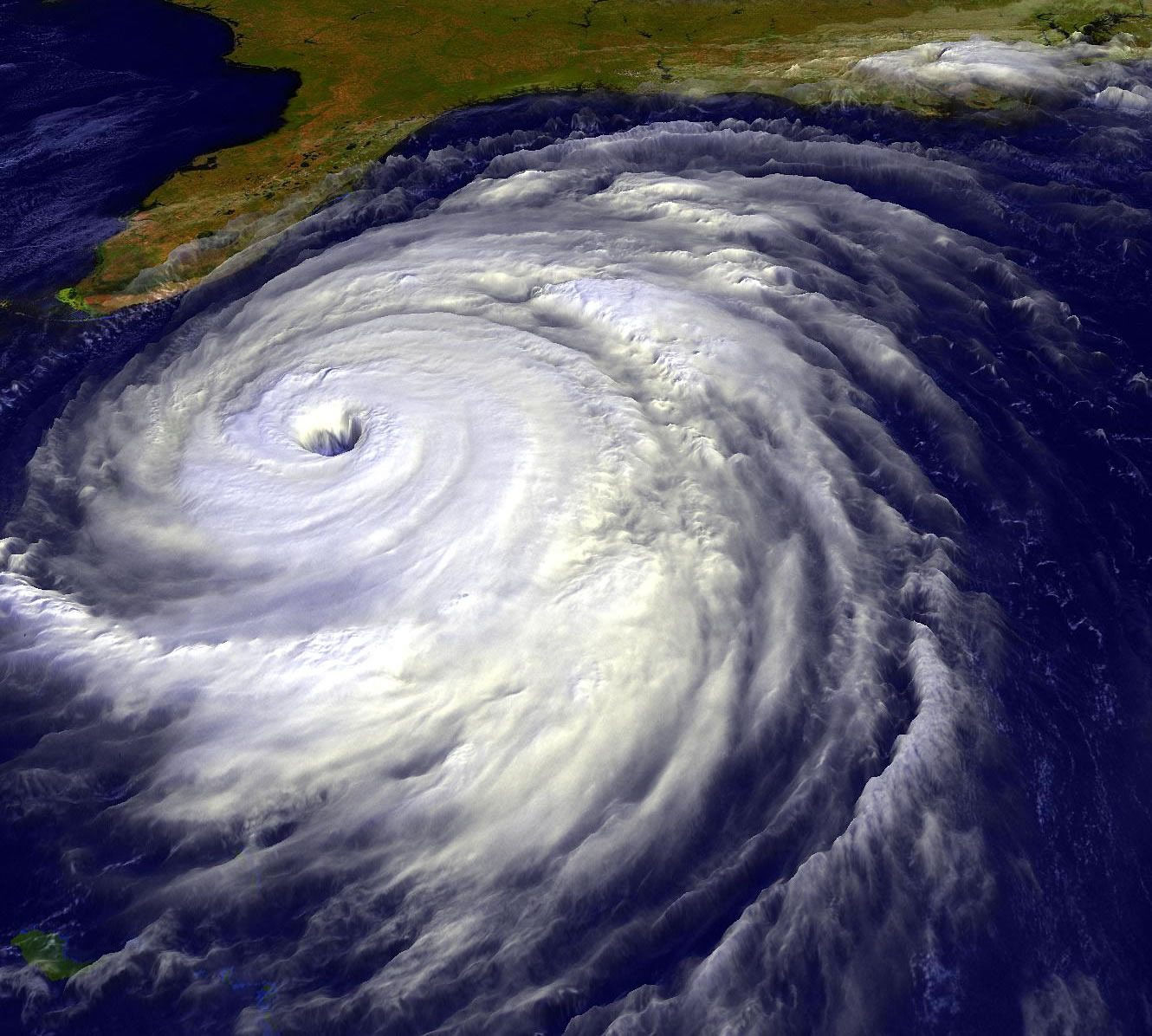

A question that I am frequently asked after a hurricane strikes is “Do I have to pay my employees for times that my business is closed during and after the storm?” The answer is a resounding “maybe”. It all depends upon the classification of employee (and company policy), and we can break it down into two distinct categories; Hourly and Salaried. Let’s look at the hourly employee first. An employee who is paid based on the hours they work would not be entitled to any legally mandated pay for time they are not working. Some states require that if an employee…

It is estimated that 41 million workers do not receive paid sick leave, but that number is going to steadily drop. This past month the President has signed into effect an Executive Order (EO 13706) that establishes paid sick leave for federal contractors. Work performed by parties that contract with the Federal Government will now be required to provide their employees with at least 7 days of paid sick leave on an annual basis. The employee will receive 1 hour of leave for every 30 hours worked, which can be used for: their own illness, injury, or medical condition; the…

Same Day ACH becomes effective on Friday, September 23rd, 2016, and one of its primary uses will be for the Direct Deposit of payroll transactions. Rather than the 1-2 day window for current ACH, payments will settle the same day for Same Day ACH. Employers should understand how they can effectively use this for those same day deposit needs. The nation’s 12,000 financial institutions will be implementing Same Day ACH, although some institutions may take longer than the end of business day to credit some employees’ accounts. By March 2018, all financial institutions will credit Same Day ACH deposits to…

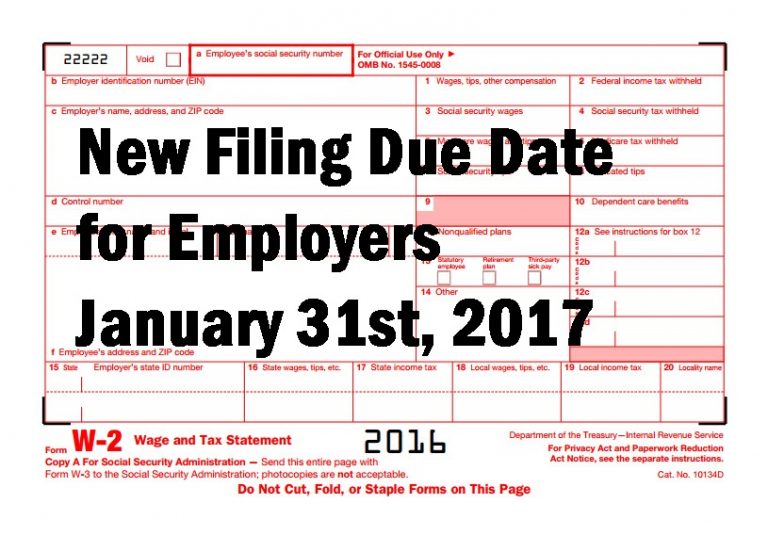

One of the items passed in The Protecting Americans from Tax Hikes (PATH) Act of 2015, which was signed into law by President Obama on December 18th, 2015, was an effort to prevent tax return fraud. The Act accelerated the filing deadline for businesses for year-end informational returns such as forms W-2 and 1099-MISC* by 60 days to January 31st of the year following the tax year of the form. This makes the SSA and IRS filing deadline of their respective forms the same as the deadline for their distribution to employees and contractors. This new deadline of January 31st…