When we are under watch for a hurricane or tropical storm, many business owners and payroll departments focus on securing their homes and business, but sometimes forget something critical. Paying your employees timely. At PayMaster, making sure your employees are paid accurately, and on time is our priority. Rest assured that if PayMaster is your payroll, time & labor, or HR partner, we will be there for you before, during*, and after the storm. *Yes, during the storm. Even though a hurricane may be passing through South Florida, PayMaster will be operating as normal during business hours whether from our…

Posts published in “Payroll”

Under regulations of Section 125 of the Internal Revenue Code, an employer can implement various Plans which allows employees an opportunity to receive certain benefits on a pre-tax basis. In this article, we will look at the Premium Only Plan (POP), where employees can elect to pay their portion of insurance premiums on a pre-tax basis, creating a savings for both the employee and the employer. Setting up a POP is simple and you just need to have a Plan Document and Summary Plan Description in place that describes all benefits and establishes the rules for eligibility and elections. (If…

Effective January 1st, 2018, employers in New York State will be required to offer Paid Family Leave coverage for their workforce. Employer’s should prepare now for this new coverage and can even voluntarily comply and start the coverage earlier. Do not wait until December 31st. New York will become the fourth state requiring family leave coverage, following California, New Jersey, and Rhode Island. This coverage provides wage replacement and job protection to employees who need time off to bond with a new born, adopted, or fostered child, care for a family member with a serious health condition, or assist…

While there are many factors to consider when hiring family members, there may be a few advantages from the payroll tax perspective. But, only if you are aware and perform the necessary overrides in your payroll system or notify your payroll service provider. Let’s break this down into the types of family relationships as the advantages are different for each. Parent employs Child – If the child is under the age of 18 and works in their parents business, their wages are not subject to Social Security (OASDI) or Medicare taxes This only if the business is setup a sole proprietorship…

United States Citizenship and Immigration Services (USCIS) Form I-9 is used for verifying the identity and employment authorization of all individuals (citizens and non-citizens) hired for employment. On July 17th USCIS released a new form and employers have 60 days to implement this new version. First introduced in November 1986, this form is completed by both the newly hired Employee (where they state their eligibility to work -Section 1), and the Employer (where they verify the employee’s eligibility -Section 2) within three days of hire. The list of acceptable documents referenced by the employer to verify the employee’s eligibility…

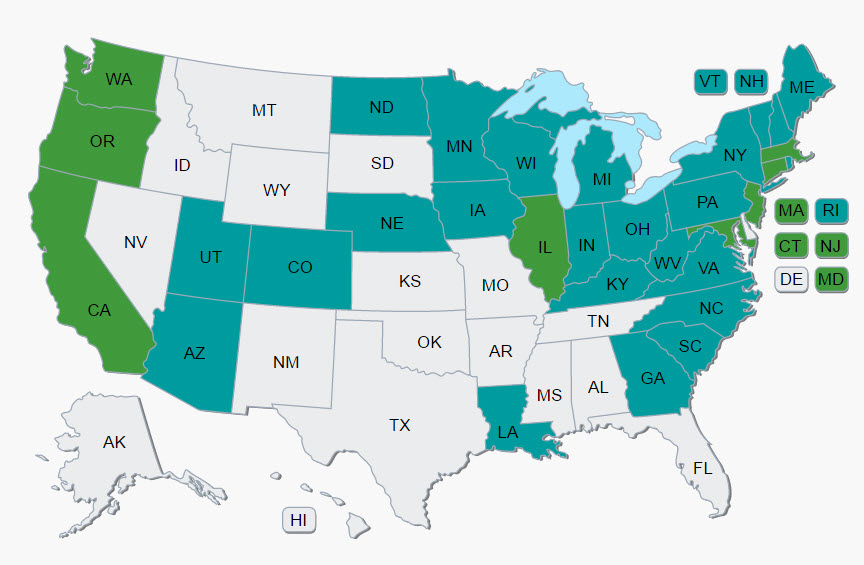

Under the provisions of the American Federal Unemployment Tax Act (FUTA), a Federal tax is levied on employers covered by the Unemployment Insurance program at a current rate of 6.0% on wages up to $7,000 a year paid to a worker. The law, however, provides a credit against federal tax liability of up to 5.4% to employers who pay state taxes timely under an approved state UI program. Accordingly, in states meeting the specified requirements, employers pay an effective Federal tax of 0.6%, or a maximum of $42 per covered worker, per year. The credit against the Federal tax may…

Compensatory time, aka Comp Time, has been an acceptable practice for government employees, but a recent bill passed by the House on May 2nd moves on to the Senate. Comp time is formally defined as time off that is accrued by an employee in exchange for cash overtime pay, or more precisely as 1.5 hours of Comp time in exchange for 1 hour worked of overtime. While this may be happening in private businesses today, it is currently a violation of the Fair Labor Standards Act (FLSA), and the Working Families Flexibility Act of 2017 (H.R. 1180) is looking…

There is a direct correlation between the size of an employer’s workforce and the likeliness of their offering a retirement plan. While about 92% of companies having greater than 10,000 employees offer a 401(k)-style plan, those with under 10 employees, the rate drops to 8%. The flip side is that 86% of employers do not offer a plan, which translates to about 68 million Americans without access to a employer-sponsored plan, and states have taken notice. Beginning in 2017, a number of states have implemented laws requiring smaller businesses to implement a plan with many more in the legislative proposal…

Yes you do! Whether you have just one employee, the organization is a sole proprietor or corporation, nonprofit or for-profit, there are posting requirements (for every worksite) that must be complied with, otherwise the employer will face some fairly hefty penalties should there be a check. There is also exposure to employee lawsuits which can be more costly than any government agency fine. These days compliance is very easy. Many office supply stores or even online, sell “all in one” posters, but beware as they are not all created equally and you want to make sure you are covered.…

While one should always be vigilant about suspicious emails, this time of the year I recommend an even heightened scrutiny. It is not uncommon to receive requests this time of the year from employees who have not received or lost their W-2 form, and in the old days, this request came in person. Nowadays, it is not uncommon to receive a request via email that you may fulfill via replying. It certainly cuts down on the time that it used to take to find the employer’s hard copy, photo copy the copy, and mail the copy to the employee. …