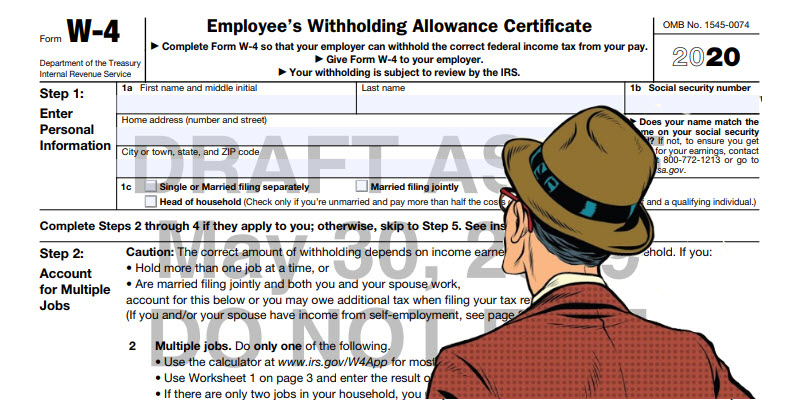

The W-4 form has remained basically unchanged for many decades. For a flashback, here is what it looked like in 1990: https://www.irs.gov/pub/irs-prior/fw4–1990.pdf. Unchanged until now, that is. The IRS has done a complete revamp of the form for 2020 by adding many additional fields for the employee to complete as well as removing ‘number of allowances.’ You may ask how that can be since the number of allowances basically dictated the amount of federal income tax withheld from a paycheck. You need to see the new form to believe it, and here it is: https://www.irs.gov/pub/irs-dft/fw4–dft.pdf. The form asks the employee…

Posts tagged as “IRS”

Ever since the 2015 Obergefell v. Hodges case in which the Supreme Court of the United States ruled that the fundamental right to marry is guaranteed to same-sex couples by both the Due Process Clause and the Equal Protection Clause of the Fourteenth Amendment to the United States Constitution, it has been shown that the number of employers offering domestic partner benefits has significantly decreased. A year before the ruling (2014), a survey reflected that 59% provided benefits to same-sex domestic partners and just one year later (2016), 48% are providing benefits with that number decreasing each year. The reason…

According to a 2017 study by CareerBuilder, they determined that 78% of US workers live paycheck-to-paycheck and 75% of workers were in debt. With those statistics, many employers find it common to be approached by an employee for a loan or advance. While it may be seen as a way to improve employee morale, productivity, and employee loyalty, there are many other factors to take into consideration to avoid a detrimental impact. In this article, I will cover some of the little known aspects of employee loans and advances. First off is whether or not the loan is going to…

Over the next few weeks, as your employees start to receive their 2018 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…

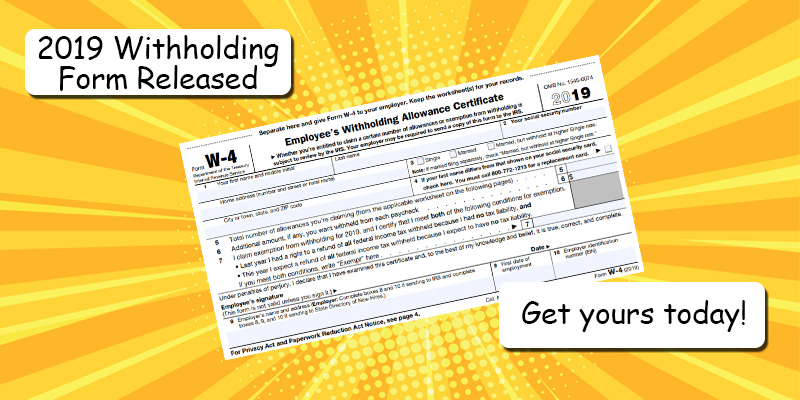

Whew! We dodged a bullet… at least for another year. If you are not familiar with what the 2019 W-4 form could have looked like, then keep an eye out for a future article where we will give it a thorough review as it is now postponed for 2020 by the U.S. Treasury. The new 2019 W-4 form has been published (including the Spanish W-4(SP) version) and not much is changed from the 2018 version. A Form W-4 remains in effect until the employee gives you a new one, so you do not need to obtain a new form each year. When…

A question I am often asked is ‘How long must I maintain my payroll records?’, and the answer is; “it depends”. Reason being is that there are many different documents that are maintained within the payroll world by a myriad of federal, state, and local agencies, and a lots of overlap. Some people put a blanket retention policy of seven years across all documents, but in some cases as we will see, even that may not be long enough. Namely if the records are for an active employee. Let’s take a look at the more popular forms and documents, and bring some order to…

Over the next few weeks as your employees start to receive their 2017 W-2 form, they will most likely have questions as to what all those numbers mean. For example, it is not uncommon for a salaried employee who earns $50,000 per year question why their Box 1 Wages only reflects $45,000. The response is, ‘do you contribute to a pension plan or have pre-tax insurance, then if so those amounts reduce your “taxable” wage, which is what appears in Box 1’. To assist you with those questions, here is an explanation of what is in each box and what…

Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…