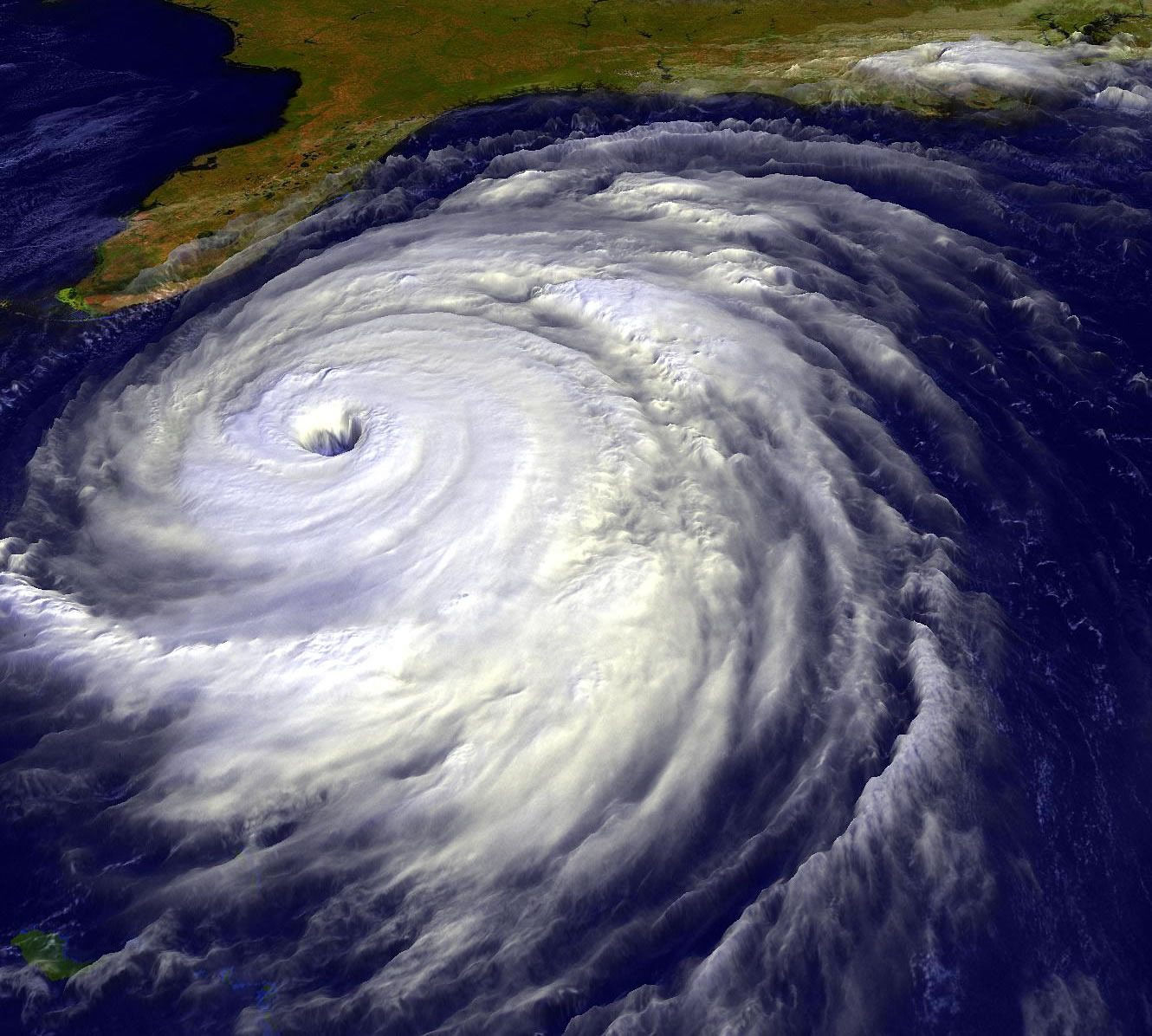

The month of June is the start of summer, but for those in southeastern states, June 1st marks the start of hurricane season. Hurricane preparedness often includes stocking up on supplies and being at the ready for physical damage to a business, but another equally important aspect is having a plan to pay your employees. At PayMaster, we have been right in the thick of things, operating our headquarters out of South Florida. Over our past 30 years, we have maintained service before, during and after any and all hurricanes that have come our way. This is due to critical…

Posts tagged as “Hurricane”

This past week, September 29th, President Trump signed into law the Disaster Tax Relief and Airport and Airway Extension Act of 2017. In addition to allowing early withdrawals and loans from retirement plans, deductions for casualty losses, and other personal tax considerations, there is an employment related tax credit for employers (Sec. 503) for retaining their employees during one of the three recent hurricanes; Harvey, Irma, and Maria. Qualifying businesses with locations in one of the Federal declared disaster areas can claim a tax credit for continuing to pay their employees during the time that the business was inoperable until…

When we are under watch for a hurricane or tropical storm, many business owners and payroll departments focus on securing their homes and business, but sometimes forget something critical. Paying your employees timely. At PayMaster, making sure your employees are paid accurately, and on time is our priority. Rest assured that if PayMaster is your payroll, time & labor, or HR partner, we will be there for you before, during*, and after the storm. *Yes, during the storm. Even though a hurricane may be passing through South Florida, PayMaster will be operating as normal during business hours whether from our…

A question that I am frequently asked after a hurricane strikes is “Do I have to pay my employees for times that my business is closed during and after the storm?” The answer is a resounding “maybe”. It all depends upon the classification of employee (and company policy), and we can break it down into two distinct categories; Hourly and Salaried. Let’s look at the hourly employee first. An employee who is paid based on the hours they work would not be entitled to any legally mandated pay for time they are not working. Some states require that if an employee…