On October 28, 2021, the U.S. Department of Labor (DOL) issued a Final Rule, which takes effect on December 28, 2021; it is extremely important for businesses that pay the lower “tipped minimum wage” to take notice. In this final rule, the DOL finalizes its proposal to withdraw one portion of the Tip Regulations Under the Fair Labor Standards Act (FLSA 2020 Tip Final Rule) and finalize its proposed revisions related to the determination of when a tipped employee is employed in dual jobs under the Fair Labor Standards Act of 1938. Specifically, the Department of Labor is amending its…

Posts tagged as “FLSA”

There are many times when an employee may need to travel for business-related purposes. The latter span can include something brief, like a trip to the bank, or a cross-country flight for a business conference and depending upon the circumstances, it can be compensable time. I think the best way to tackle this is to take a look at examples as to what is and what is not: What is NOT compensable Home to work/Work to home (aka commuting) – An employee who travels from home before the regular workday and returns to his/her home at the end of the…

If you have an employee who drives their personal vehicle for a work related matter, it is the norm to reimburse the employee for the business-related use. It is a straight forward calculation by taking into consideration how many miles the person drove and multiplying it by a rate. The IRS even publishes a standard mileage rate of .58 cents per mile (2019). But what if that employee uses their mobile personal device (aka cell phone) in a Bring Your Own Device (BYOD) workplace? As employers implement paperless, streamlined, and automated solutions to their work environment, we are finding that…

With the exception of four states (Alabama, Florida, Georgia, and Mississippi), each state has specific laws regarding the issuance of a final paycheck to a separated employee. Many states differentiate whether the employee was separated voluntarily or involuntarily, and the timing ranges from “immediately” (yes, this means the same day the employee is terminated) to the next scheduled payday, so I have put together this table for quick and easy reference. Each state has penalties for violation of the final check rule, so be sure you know what is required. A state such as California will enforce the employer to…

Not knowing the difference could result in a costly Department of Labor claim. Maybe more costly than a divorce. If your employee is Engaged to Wait then that time is considered hours worked. Conversely, Waiting to be Engaged are off-the-clock hours, thus not hours worked or compensable under the Fair Labor Standards Act (FLSA). So what is the difference between the two? I am glad you asked. Engaged to Wait is time spent primarily for the benefit of the employer, and how much restraint is placed on an employee who is waiting. Let’s look at a few examples to…

Compensatory time, aka Comp Time, has been an acceptable practice for government employees, but a recent bill passed by the House on May 2nd moves on to the Senate. Comp time is formally defined as time off that is accrued by an employee in exchange for cash overtime pay, or more precisely as 1.5 hours of Comp time in exchange for 1 hour worked of overtime. While this may be happening in private businesses today, it is currently a violation of the Fair Labor Standards Act (FLSA), and the Working Families Flexibility Act of 2017 (H.R. 1180) is looking…

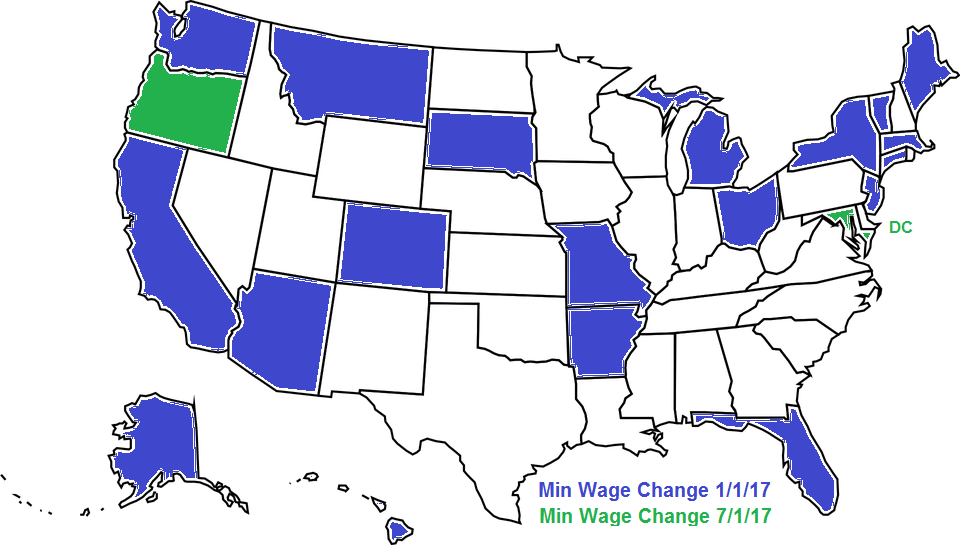

Happy New Year! With the new year comes 19 states changing their minimum wage effective January 1st, and another three states implementing a change effective July 1st. While the federal minimum wage remains the same at $7.25 per hour, the minimum wage for federal contractors has increased to $10.20 per hour. The following states will have a minimum wage change effective January 1st; (click on the state name for additional information) Alaska 9.80 Arizona 10.00 Arkansas 8.50 California 10.50 Colorado 9.30 Connecticut 10.10 Florida 8.10 Hawaii 9.25 Maine 9.00 10.68 Portland Massachusetts 11.00 Michigan 8.90 Missouri 7.70 Montana 8.15…

A federal Judge on Tuesday blocked the law that was passed on May 17th, 2016 to increase the minimum salary amount a worker can earn and remain exempt from overtime pay. U.S. District Judge Amos Mazzant, of Texas, agreed with 21 states and a coalition of business groups, including the U.S. Chamber of Commerce, that the rule is unlawful and granted their motion for a nationwide injunction. Mazzant stated that the federal law governing overtime does not allow the Labor Department to decide which workers are eligible based on salary levels alone. The rule was to take effect on…

To pay Weekly or Biweekly (or some other frequency), that is the question. The US Department of Labor (DOL) does not specify any sort of frequency in which employees should be paid minimum wages or the overtime compensation it calls for. Instead the language states that “Wages required by the Fair Labor Standards Act (FLSA) are due on the regular payday for the pay period covered.” While this seems vague, the DOL takes this principal seriously. For example, if an employee fails to record time worked or submit a timesheet, and the employer is aware that work was performed, the…