The SECURE 2.0 Act of 2022 was designed to enhance retirement savings for Americans by making it easier and more affordable to save. Each year, since the signing of this act, we have seen plan rules change, and 2026 will mark another key change in how catch-up contributions will be handled for high wage earners. The current rules state that if you are aged 50 or over, at any point during the calendar year, you can contribute an additional $7,500 on top of the regular contribution limit. The latter is also known as a catch-up contribution. For 2025, the regular…

Posts tagged as “401k”

Most years, the only thing we have to worry about when it comes to retirement plan administration is adjusting for the cost-of-living increase to contribution limits. Some years we don’t even have that, but this year is an exception with that, plus major changes you will need to make and consider. So first, the easy stuff. The cost-of-living increase, to the maximum amount an individual can contribute to their 401(k), 403(b), governmental 457 and the Thrift Savings plans, will be increased to $23,500, up from $23,000 in 2024. The catch-up contribution will remain at $7,500 and the limit on annual…

They say timing is everything, and if there were ever a time to implement a 401(k) plan, the time is now. We first wrote about the Secure Act 2.0, in this post back in February 2023, a short time after it was signed into law by President Biden. One of the best parts of this act is that the government wants to give business owners money to start a plan AND even better, they want to give you money to give to your employees. This is accomplished in three different tax credits to small business owners, as covered below. Let’s…

Whether you are a working employee, someone in their retirement or an employer/plan sponsor, the SECURE 2.0 Act of 2022 has something for everyone. It was included as part of the Consolidated Appropriations Act, 2023, which was passed by Congress on December 23, 2022 and signed into law by President Biden on December 29, 2022. While there is something for everyone, we will focus on the areas in which it affects employers. Some items are effective this year while others will phase in over the next couple of years, but it may be a good idea to start planning today.…

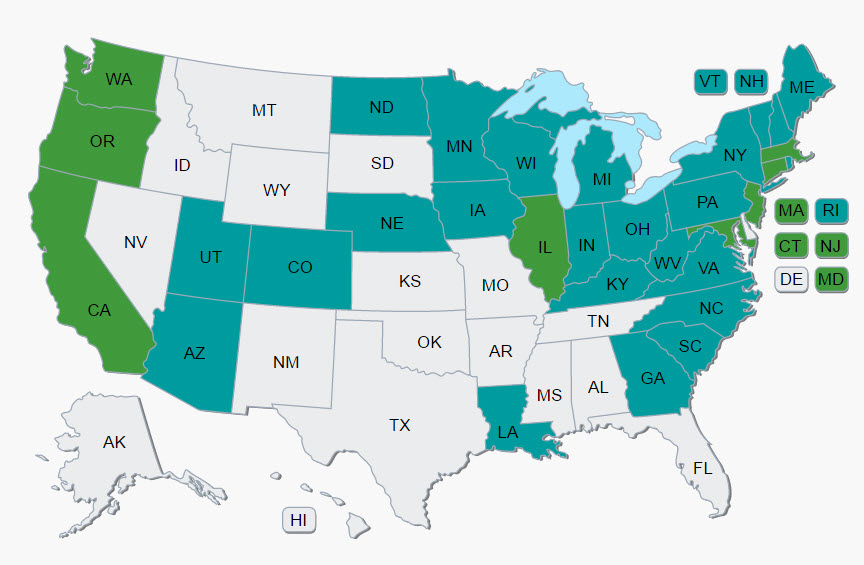

There is a direct correlation between the size of an employer’s workforce and the likeliness of their offering a retirement plan. While about 92% of companies having greater than 10,000 employees offer a 401(k)-style plan, those with under 10 employees, the rate drops to 8%. The flip side is that 86% of employers do not offer a plan, which translates to about 68 million Americans without access to a employer-sponsored plan, and states have taken notice. Beginning in 2017, a number of states have implemented laws requiring smaller businesses to implement a plan with many more in the legislative proposal…