Do you own a business in the District of Columbia? Here’s some helpful information and links.

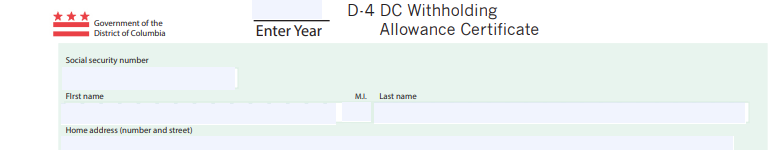

District of Columbia does have state income tax. Employers should have their employees fill out for D-4.

Additional information of District of Columbia state income withholding tax, please visit here.

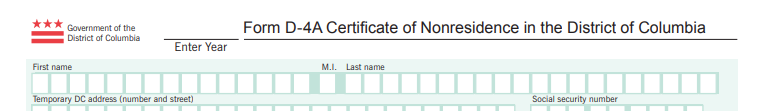

District of Columbia has reciprocity agreements with Maryland and Virginia. If an employee lives in one of those states they should fill out form D-4A