Cyber crimes continue to rise, and big companies are no longer the sole target. The FBI recently issued their 2024 annual report on internet crimes and there were 859,532 complaints filed, totaling $16.6 billion in losses last year. That represents a 33% increase in losses, compared to 2023. The average loss is $19,372, and those numbers only represent what has been reported to the FBI. The actual loss is estimated to be much greater, as most losses go unreported.

Fortunately, there are ways to protect your business from cyber criminals, like having secure networks and training your staff to look out for phishing scams and fraudulent emails infecting your system and stealing your data. Even with all of the safeguards in place, businesses are still at risk, legally and financially. The good news is that commercial insurance carriers are starting to make cyber insurance more readily available, at a reasonable premium.

When we think of security, we think about securing our own bank accounts and assets, but responsibility goes beyond that. Many businesses store sensitive information on their systems, such as phone numbers, social security numbers, bank account details, client credit card and payment information and other Personally Identifiable Information (PII). It’s exactly that kind of data cyber criminals are looking for. If you store any sensitive customer or employee data, consider purchasing cyber liability coverage.

The most common cyberattacks target your networks, resulting in either information theft (data breaches) or forcing you to pay to get your information back (ransomware). They do this by gaining access to your passwords. Believe it or not, there are many people still using “password” as their password. Check out this recent article with the top 10 most common passwords. Hopefully a password you use is not on this list.

If your business has “guest” Wi-Fi or even password-protected Wi-Fi for your employees, there’s an opening for cyber criminals to hack into your system. With cyber liability insurance, the financial fallout from breaches and attacks is typically covered, and so are the costs of notifying your clients of the breach.

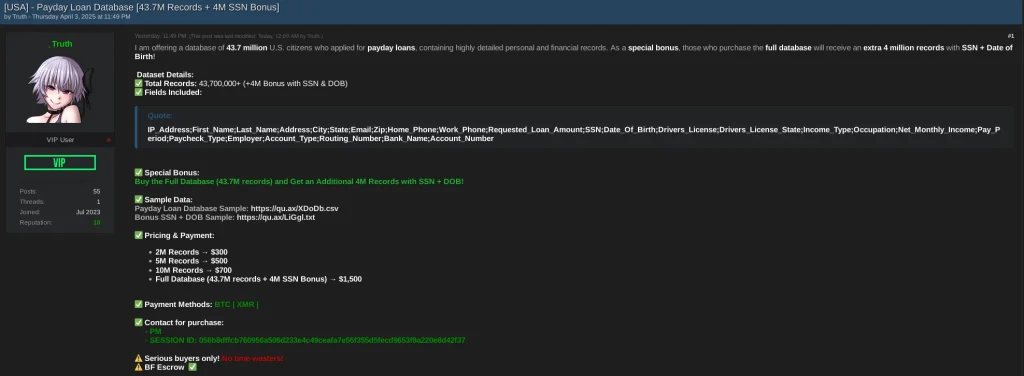

What happens when cyber criminals acquire data through a breach? They either exploit it for their own use, or they sell it on the Dark Web. Just last month, a massive payday loan database containing 43.7 million U.S. records has been leaked and is now being sold on a cybercrime forum by a threat actor using the alias “Truth.” The dataset includes highly sensitive information such as Social Security Numbers (SSNs), dates of birth (DOBs), and other personal details, with an additional 4 million “bonus” entries offered. The entire database of personal information is only $1,500.

If you’re not sure if you need cyber insurance, you can reach out to your insurance agent or chat with one of our insurance experts to determine your risk level and provide additional information to decide if cyber insurance is right for your company.

While we make every attempt to ensure the accuracy and reliability of the information provided in this document, the information is provided “as-is” without warranty of any kind. Romeo Chicco or PayMaster, Inc. does not accept any responsibility or liability for the accuracy, content, completeness, legality or reliability of the information contained. Consult with your CPA, Attorney, Security Professional and/or HR Professional as federal, state, and local laws change frequently.