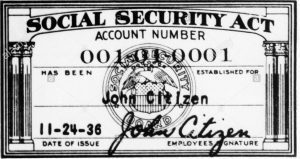

The first Social Security Numbers were issued in November 1936, and back then, they were issued through the U.S. Postal Service as the Social Security Administration deemed that was the most efficient way to reach the American workforce. Much like today, individuals completed the SS-5 form to request a number, and they were printed at one of the 1,074 post offices that were designated as a “typing center” before being distributed back to the individuals local post office. Fun fact #1, the first established number 055-09-0001 was issued to John D Sweeney, Jr. He died in 1974 at the age of 61 without ever receiving any benefits from the social security program.

As this was more than a decade before the invention of computers, Social Security Numbers were distributed geographically to avoid two different post offices from issuing the same number. The state that issued the SSN would then store all records for that person throughout their working life, so this numbering also aided in the ability to track the person back to their originating state. Even though computers were later implemented, this practice of issuing numbers based on state continued until June 25th, 2011. At that point, all newly issued numbers became completely randomized in an effort to combat identity theft. Prior to that date, a number can expose some information about the individual such as when and where they were when the number was issued to them. The first three digits of the SSN is the Area and tells you which state a number was issued. Basically, starting in the northeast states and moving southwest the Area would increase, starting with New Hampshire being 001-003, then Maine at 004-007, etc. Click here to see a list of states and their Area number. The second set of two digits is the Group, and paired with the Area it can be used to determine when a block of SSNs were issued. The last four digits is the Series and were issued sequentially. This tool will allow you to enter a state and year of birth, and it will generate the first 5 digits. That along with knowing someones last 4 digits, which is commonly used in employment practices, and we can see why randomization came into effect.

Fun fact #2, the most misused SSN of all time is 078-05-1120, and was issued to Hilda Schrader Whitcher in 1937. In 1938, Hilda worked as a secretary for wallet manufacturer E.H. Ferree. Her boss thought it would be a clever marketing idea to show that the new Social Security Cards would fit into their wallets, but rather than using sample card, he used copies of her actual SSN. Oops. These wallets were sold all over the country and by 1943, 5,755 people were using her SSN, and as late as 1977 there were still 12 people.

While on the subject of identity theft we can’t go without mention of a runner up, although he is a victim of his own arrogance. SSN 457-55-5462 is issued to Todd Davis, CEO of LifeLock, and his identity has been stolen at least 13 times, since his genius idea of publishing his SSN and challenging people to steal it. People have opened up utility accounts, obtained loans, and even cell phone service in his name leaving thousands of dollars of debt.

Here are a few quick keys in determining whether a SSN is valid.

- No SSNs will begin with the number 9

- No SSNs will begin with the number 000 or the ‘number of the beast’ 666

- No SSNs will contain 00 as the Group (two digits in the middle)

- No SSNs will contain 0000 as the Series (last four digits)

Prior to Randomization;

- Area numbers from 700-728 were issued to Railroad Workers

- Area numbers from 729 to 733 were issued to Naturalized Citizens

- Area numbers greater than 899 and the Group numbers from 70-88 are Tax Identification Numbers and not Social Security Numbers

While the SSN is the number used for tracking individuals, it was not until the late 1980s when the IRS began requiring that dependents aged 2 or older claimed on a Federal income tax return must have a number. It was not long after that hospitals adopted the Enumeration at Birth policy, although this is optional as decided by the parents. Fun fact #3, as long as a person never works in the US or is claimed as a dependent on a federal tax return, having a SSN is never required.

Here are a few helpful links:

Looking to validate whether a SSN is good or not, use SSAs Verification Service.

Create an online account with SSA and login to view your future benefits as well as verify wages posted to your account mySocialSecurity.

If you are a client of PayMaster, then each year in November, we offer a service to verify all of your employee’s SSNs prior to year-end and the production of the W-2 forms. Look for information in your year end questionnaire.

If you would like to verify a SSN prior to hire, then you can utilize the SSN Verification on an individual basis within PayMaster HCM.