If you are like me, you have been at the edge of your seat waiting for the IRS to release the 2018 Form W-4, Employee Withholding Allowance Certificate since January 1st. Well, on February 28th the wait ended, and here is the new form in all four pages of glory. Yes, four pages. Double the prior year’s 1 page front and back form.

At the end of the day, the certificate itself is still just a 1/3 of the first page where the employee will basically indicate whether they are withholding at Single, Married, or Married, but withhold at the higher Single rate and the number of allowances and additional amount, if any. How the employee arrives at their number of allowances is another story, and one that could require an accounting degree to figure out. As a side note, if you have claimed Exempt from withholding for 2017 on line 7, you are required to complete a new 2018 form.

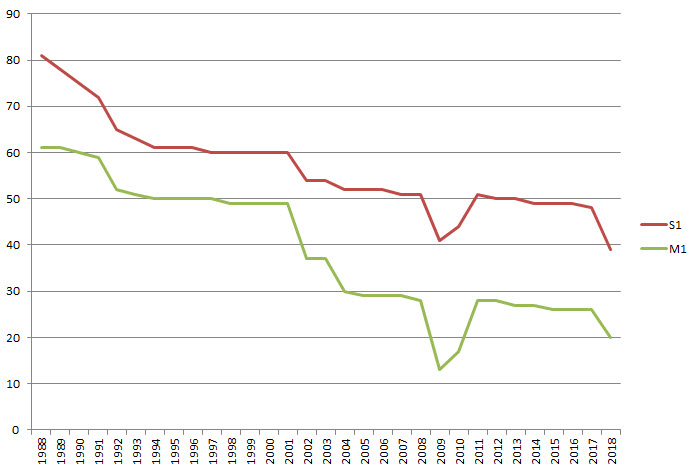

Since the new tax withholding tables were released back in mid-January, most employees found a decrease in the amount of their federal tax withheld, thus an increase in their net check. Is this something new? Not at all. I was so curious about this question, that I found the tax withholding tables going back to 1988 and I calculated the federal income tax withheld for a person claiming Single and 1 Allowance as well as Married and 1 Allowance, both earning $500 per week. The results were surprising, with the tax withholding on someone earning $500 back in 1988 at $81 for S-1 and $61 for someone claiming M-1. Compare that to today and the same person would be at $39 and $20, respectively. A more than 50% decrease in the amount of federal income tax withheld for the person claiming S-1 and a 67% decrease for M-1. A graph is below of each year and we find a steady decrease, with the exception of 2009 and 2010 where there was the large dip.