Ever since the IRS did away with the Advanced Earned Income Credit (EIC) in 2010, Box 9 on the W-2 form has sat there unused and neglected as a greyed out box. The instructions simply read “Do not enter an amount in box 9.” Now, six years later, the IRS has an idea to help combat tax-related identity theft and refund fraud. Their objective is to utilize this box to verify that the W-2 data submitted by taxpayers on e-filed returns is legitimate. This year, the IRS will run a pilot program where a limited number of W-2s…

Posts published in January 2017

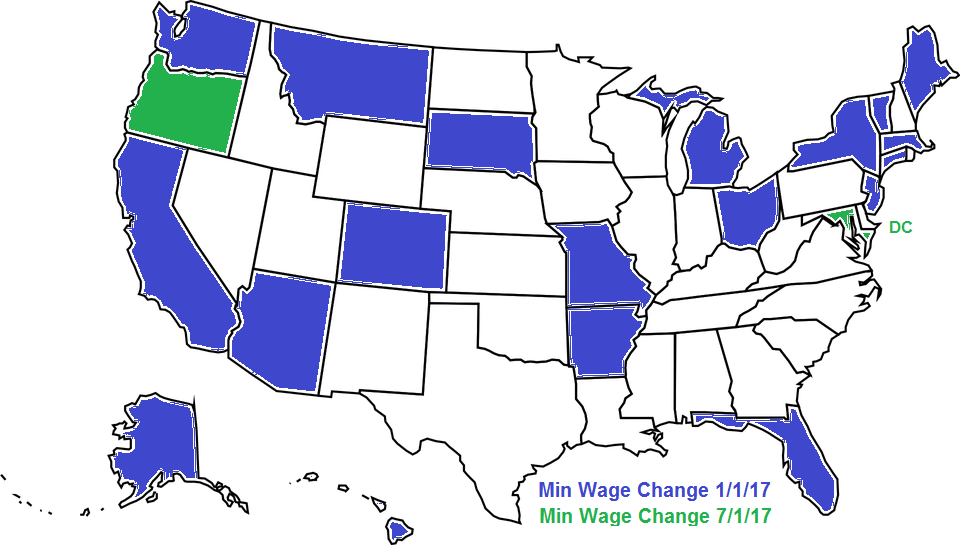

Happy New Year! With the new year comes 19 states changing their minimum wage effective January 1st, and another three states implementing a change effective July 1st. While the federal minimum wage remains the same at $7.25 per hour, the minimum wage for federal contractors has increased to $10.20 per hour. The following states will have a minimum wage change effective January 1st; (click on the state name for additional information) Alaska 9.80 Arizona 10.00 Arkansas 8.50 California 10.50 Colorado 9.30 Connecticut 10.10 Florida 8.10 Hawaii 9.25 Maine 9.00 10.68 Portland Massachusetts 11.00 Michigan 8.90 Missouri 7.70 Montana 8.15…