Did you hire someone who is giving you pushback on submitting a W-4 form, or maybe they even presented you with a little-known tax form stating that they do not pay taxes? If so, you may have hired a tax protestor. No need to panic; you may be able to talk some sense into them. Tax protestors could simply be misinformed individuals, and with social media exposure, that is easy to come by. I have seen TikTok videos, X posts, YouTube and the like, falsely leading people down this path. They claim that taxation is voluntary, does not apply to them and mislead others into doing the same.

The IRS has a website of all of the frivolous tax arguments. They include the belief that taxation is voluntary, religious beliefs (First Amendment), taking of property without due process, self incrimination (Fifth Amendment), unconstitutional (Sixteenth Amendment) and dozens of other reasons. It is quite entertaining to read, and the website cites relevant case law that debunks each argument. To keep this article short, I am not going into each possible protest and response; rather, will keep this in a more general direction of what to do when you have a tax protestor.

IRS Publication 15, known as Circular E, guides employers on what to do if an employee does not submit a W-4 form. According to this document, if your employee refuses to provide a W-4 tax withholding form and you have no valid previously-submitted W-4, you must withhold federal income tax from the individual as a single adult with no other deductions. This means the employee will be taxed at the highest rate possible for their income bracket. If the employee makes any additions or changes to the W-4 form itself, the W-4 form is invalid and you would proceed as if no form was submitted. For example, if they take out any language by which the employee certifies that the form is correct, material defacing of the form or any writing on the form other than the entries requested. If they complete the form but then advise you that information on the W-4 form is false, then the form would also be considered invalid. For example, if the employee enters a high amount of dependent credits and tells you that they don’t really have any children and are doing so just to avoid tax withholding.

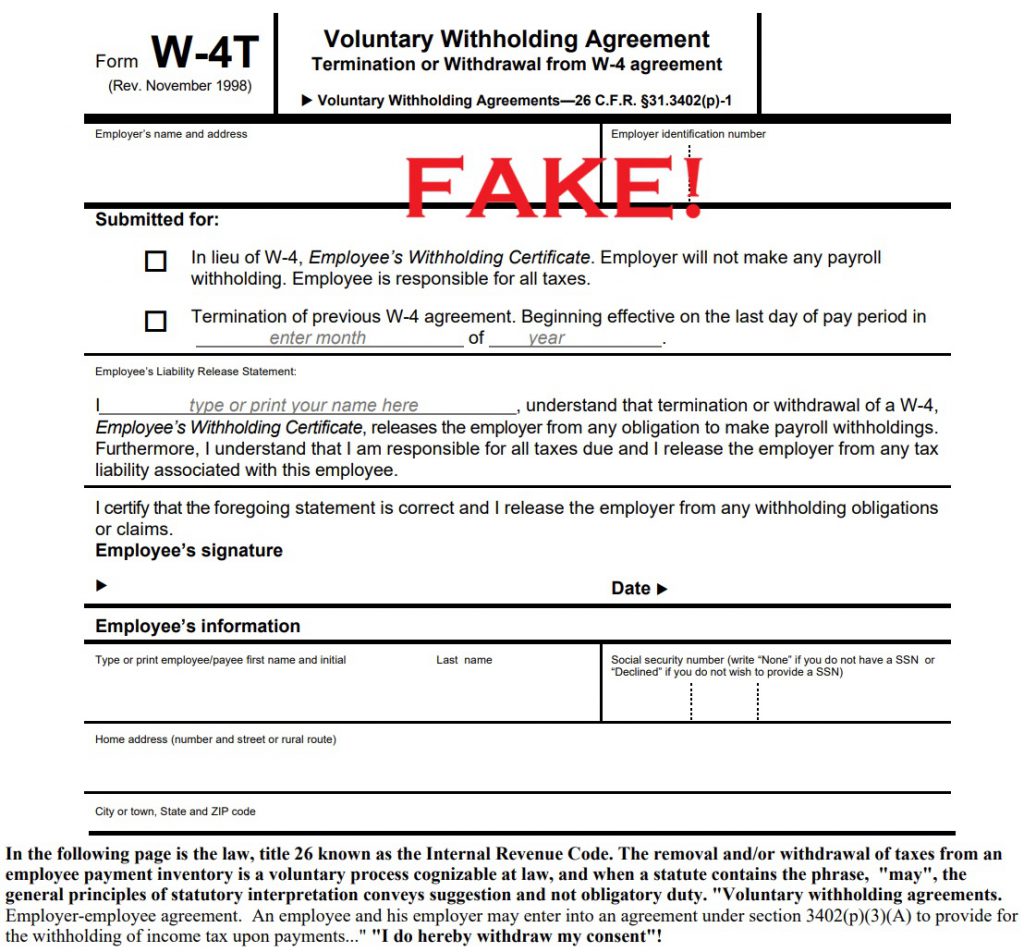

Some tax protestors are using a fake tax form named the W-4T Voluntary Withholding Agreement. (Yes, that is a link to the fake form, but it is for reference only. DO NOT USE IT!) This form looks as official as it gets. It quotes IRS code section, has a form number and revision date and is laid out just like a form, but it is 100% fake. An unsuspecting employer may think this is real, follow the instructions, and unknowingly aid and abet a tax protestor, which may inadvertently lead to penalties on the employer. Employers found to have willfully failed to withhold the necessary taxes could be subject to a maximum $10,000 fine, up to five years of imprisonment or some combination of both (26 U.S. Code § 7202).

I just watched a YouTube video of someone who provides a ten-minute tutorial on how to complete the above form. He has 75,000 subscribers and the video has 1,200 likes.

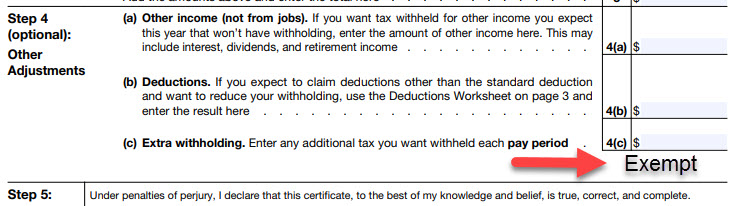

It is possible to be exempt from paying taxes, and there is a right way to claim it with an employer. Situations, such as someone who works and earns a minimal amount of income each year, is the most common reason. They fall below the income limit to pay taxes, in which case, they can claim exempt from withholding tax. This may be the case for a youth who works for a couple of months over the summer and earns just a few thousand dollars. To properly claim exempt from withholding, the employee would hand write the word ‘EXEMPT’ in the space below line 4(c) on the W-4 form, as exampled below. It is somewhat hidden in the instructions and not clearly stated on the form itself, but this is how it is done.

Keep in mind the rule above, where if the employee tells you they do this to avoid paying taxes because of their religious beliefs, that taxes are unconstitutional or they use other avoidance techniques, then treat them as if they did not submit a form and withhold federal income tax as if they are Single with no deductions. As an employer, it is not your duty to ask why they are claiming Exempt from withholding, but if they voluntarily disclose it, then you need to act upon it.

Benjamin Franklin has the best quote to wrap up this article. “Our new Constitution is now established, and has an appearance that promises permanency; but in this world, nothing can be said to be certain, except death and taxes.”

While I make every attempt to ensure the accuracy and reliability of the information provided in this article, the information is provided “as-is” without warranty of any kind. PayMaster, Inc. and Romeo Chicco do not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained. Consult with your CPA, Attorney, tax professional, and/or HR Professional.