Do you own a business in North Dakota? Here’s some helpful information and links.

North Dakota does have state income tax, however they do not have a separate form. The federal W-4 form works for both the federal and state income withholdings.

Additional information regarding North Dakota’s state income withholding tax can be found here.

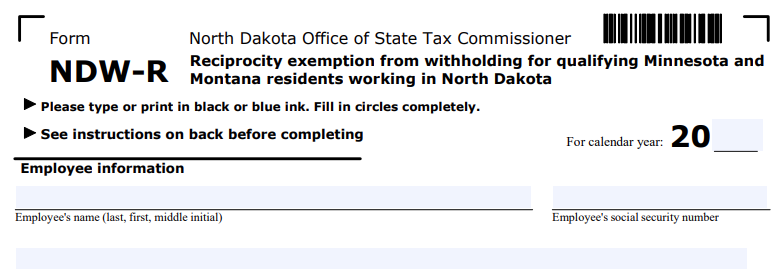

North Dakota has income reciprocity agreements with Minnesota and Montana. If you have employees that live in those states they should fill out form NDW-R.