Do you own a business in Kentucky? Here’s some helpful information and links.

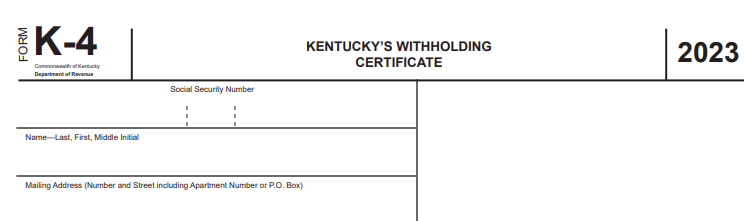

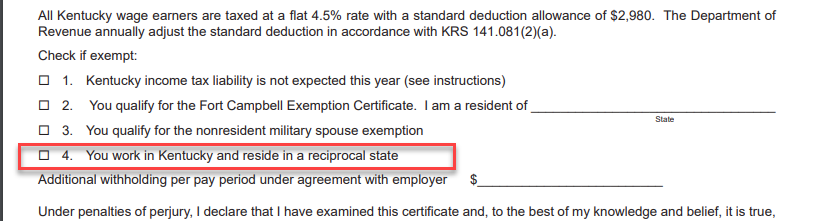

Kentucky does have state income tax. Employers should have their employees fill out for K-4.

Additional information on the state income withholding tax can be found here.

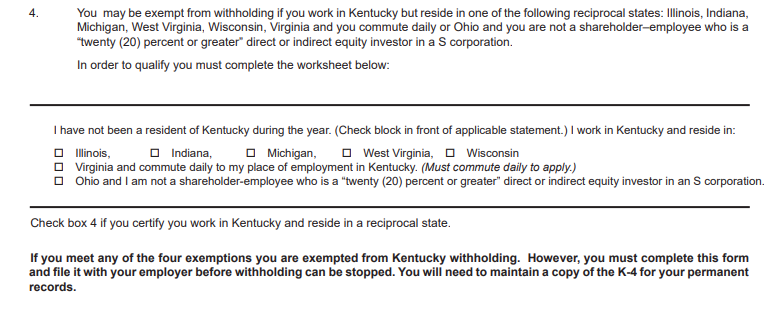

Kentucky has reciprocity agreements with Illinois, Indiana, Michigan, West Virginia and Wisconsin. There are conditional reciprocity agreements with Virginia and Ohio.

For Virginia: Employees must commute daily from their Virginia residents to their place of employment in Kentucky.

For Ohio: Employee that reside in Ohio but work in Kentucky can not be an stockholder-employee who is 20% or greater direct or indirect equity in an S corporation.

Employees that live in any of these states and meet the conditions should indicate so in box 4 on their K-4 form.

Additional information on the reciprocity agreements can be found here.