The Employee Retention Tax Credit (ERC), a program to financially help businesses adversely impacted by COVID-19, has turned into a nightmare for the IRS, as they continue to combat dubious filings.

We saw back in September, the IRS announced a moratorium on the processing of claims filed after September 15, 2023, and the slower processing of returns they had received prior to that date. Then, a month later in October, the IRS urged business owners with pending ERC claims, who did not believe they were eligible, to consider a withdrawal program that allows them to remove a pending ERC claim with no interest or penalty. Details on the withdrawal program can be found at the IRS website. This option is only for businesses that have not received or deposited their refund.

As part of their ongoing initiative aimed at combating these fraudulent claims, the IRS announced, last week, Announcement 2024-3, a new Voluntary Disclosure Program (VDP) to help businesses that want to pay back the money they received after filing ERC claims in “error.”

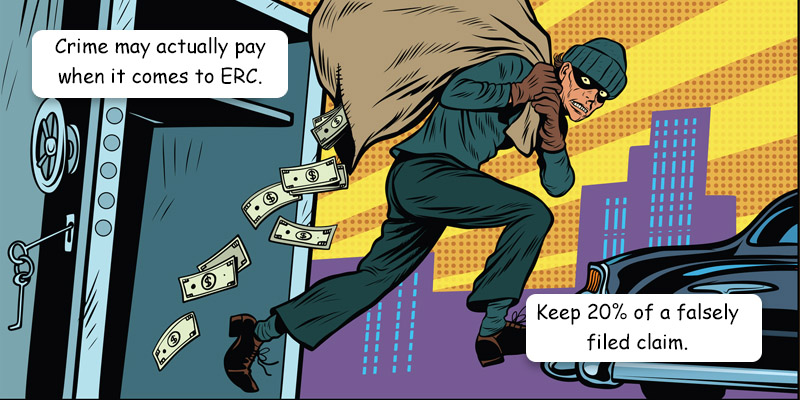

The IRS is offering eligible employers the opportunity to repay only 80% of their claimed ERCs; it recognizes that there are well-intentioned businesses that wish to correct and pay back credits they received erroneously, perhaps in connection with unscrupulous promoters using aggressive marketing tactics, and have concerns about paying back the portion of the credits paid to such promoters. Yes, if you filed a fraudulent claim, either originally knowingly or unknowingly, you can keep 20% of it, plus all of the interest, penalty free!

In addition to repaying only 80% of its claimed ERC without penalty and interest, an eligible employer won’t be required to reduce its wage expense initiated in the previously claimed ERC. However, if the full 80% is not fully repaid on time, e.g., if the taxpayer enters into an installment agreement to repay that amount, interest and penalties may still apply.

An employer that has received an ERC refund is eligible for the VDP if application to the program is made on or before March 22, 2024 and if:

- The employer is not under criminal investigation and hasn’t been notified that the IRS plans to commence a criminal investigation.

- The IRS hasn’t received or acquired information about the employer’s noncompliance.

- The tax periods for which the employer is applying for relief are not currently being examined.

- The employer hasn’t already received notice and demand for repayment of the claimed ERC.

- Return preparers or advisors assisted with the claim for credit or refund; the application to the program must include the names, addresses and phone numbers of these persons and a description of the services they provided.

An employer that claimed the ERC on an employment tax return, filed under a third party payer’s EIN (aka PEO/Employee Leasing,) may participate in this voluntary disclosure program, but the third party payer must apply on the employer’s behalf.

After filing under the VDP, the IRS will request the applicant to execute a closing agreement. Executing that agreement won’t preclude the IRS from investigating any associated criminal conduct or recommending prosecution for violation of any criminal statute, and it won’t provide any immunity from prosecution.

Unfortunately, what all of this means for those businesses that have a legitimate claim they are waiting on, is that there are going to be further delays. There was a time, early on in the ERC processing, where refunds were taking almost a year. That decreased to just a few months back in Fall 2022, but it seems like it could easily reach the year mark again. With the slower processing, the IRS recently reported that they have over 1,000,000 ERC returns in their queue; their largest backlog ever.

It is also possible that the IRS may not issue any refunds, now that the VDP is in place, until it expires in March 2024. They may want to force the business owner, whose return is questionable, to withdraw their return, rather than send a refund, allowing them to VDP, and keep 20%. We will see as time goes on.

Lastly, the time to file a legitimate claim is April 15, 2024, for a credit on any tax period in 2020, so there may be a final push and a significant amount of returns filed in the coming months, adding to the already enormous backlog.

While we make every attempt to ensure the accuracy and reliability of the information provided in this document, the information is provided “as-is” without warranty of any kind. Romeo Chicco or PayMaster, Inc does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the information contained. Consult with your CPA, Attorney, and/or HR Professional as federal, state, and local laws change frequently.