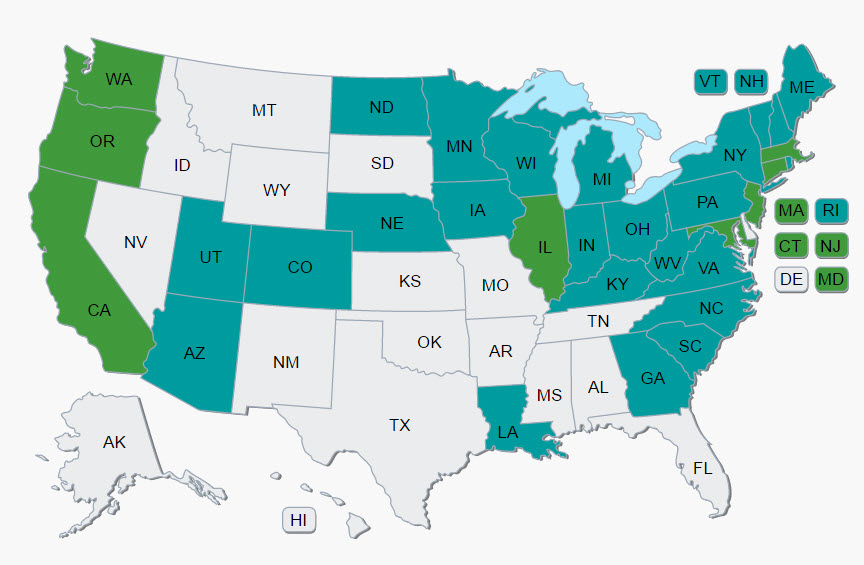

There is a direct correlation between the size of an employer’s workforce and the likeliness of their offering a retirement plan. While about 92% of companies having greater than 10,000 employees offer a 401(k)-style plan, those with under 10 employees, the rate drops to 8%. The flip side is that 86% of employers do not offer a plan, which translates to about 68 million Americans without access to a employer-sponsored plan, and states have taken notice. Beginning in 2017, a number of states have implemented laws requiring smaller businesses to implement a plan with many more in the legislative proposal…

Posts published in “Benefits”

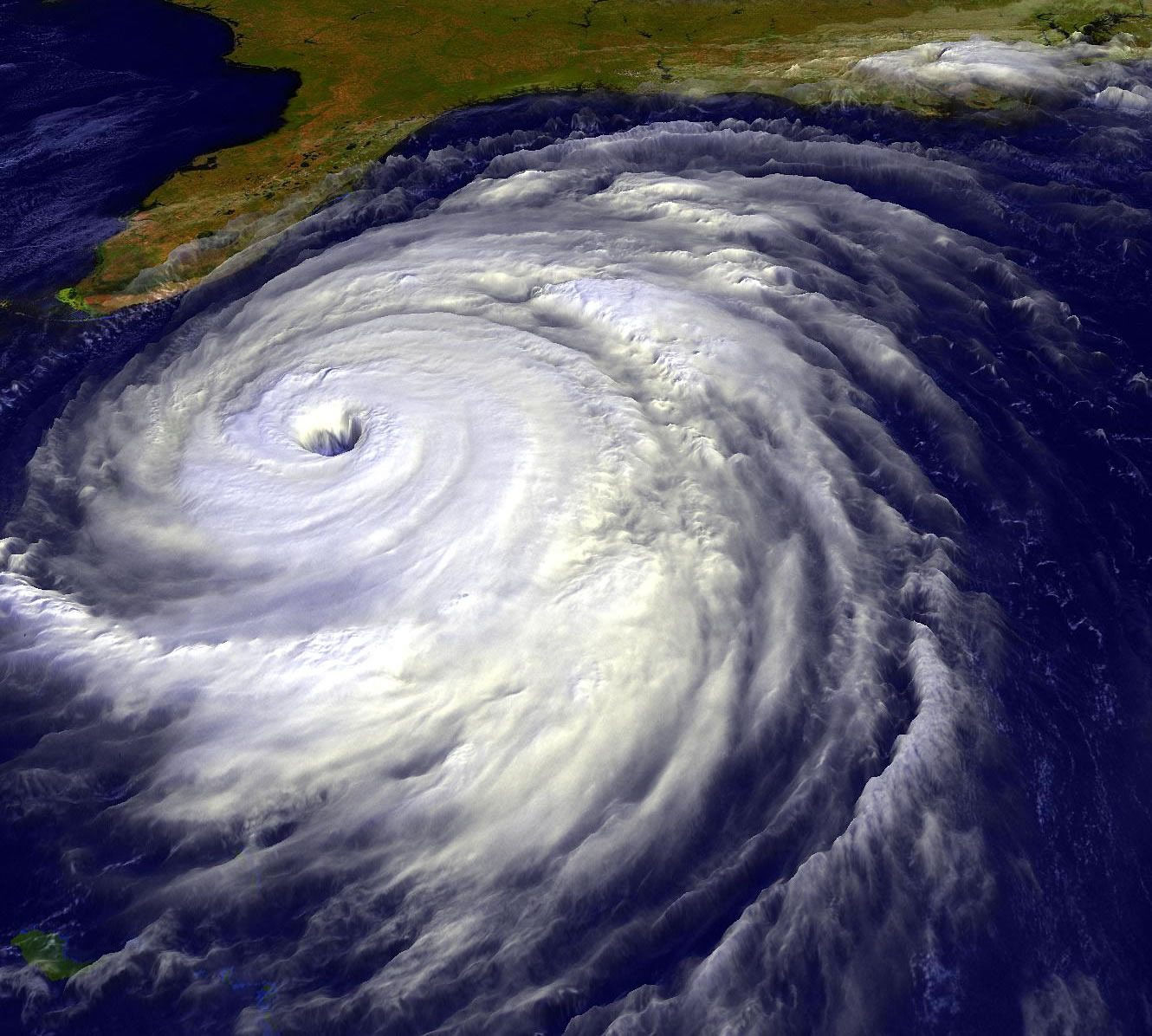

A question that I am frequently asked after a hurricane strikes is “Do I have to pay my employees for times that my business is closed during and after the storm?” The answer is a resounding “maybe”. It all depends upon the classification of employee (and company policy), and we can break it down into two distinct categories; Hourly and Salaried. Let’s look at the hourly employee first. An employee who is paid based on the hours they work would not be entitled to any legally mandated pay for time they are not working. Some states require that if an employee…

It is estimated that 41 million workers do not receive paid sick leave, but that number is going to steadily drop. This past month the President has signed into effect an Executive Order (EO 13706) that establishes paid sick leave for federal contractors. Work performed by parties that contract with the Federal Government will now be required to provide their employees with at least 7 days of paid sick leave on an annual basis. The employee will receive 1 hour of leave for every 30 hours worked, which can be used for: their own illness, injury, or medical condition; the…

This time of the year is a popular time to give gift cards to your employees as a way of showing appreciation, but you need to be sure it is reported as wages, and they pay tax on the value. Whether it is a $5 Starbucks card to a $50 gift card at a brand store, or even just a Visa gift card for $X amount, you need to include the full value of the gift in the employee’s taxable wages. The IRS considers gift cards as a cash equivalent, no matter what the value, and it does not fall under their…