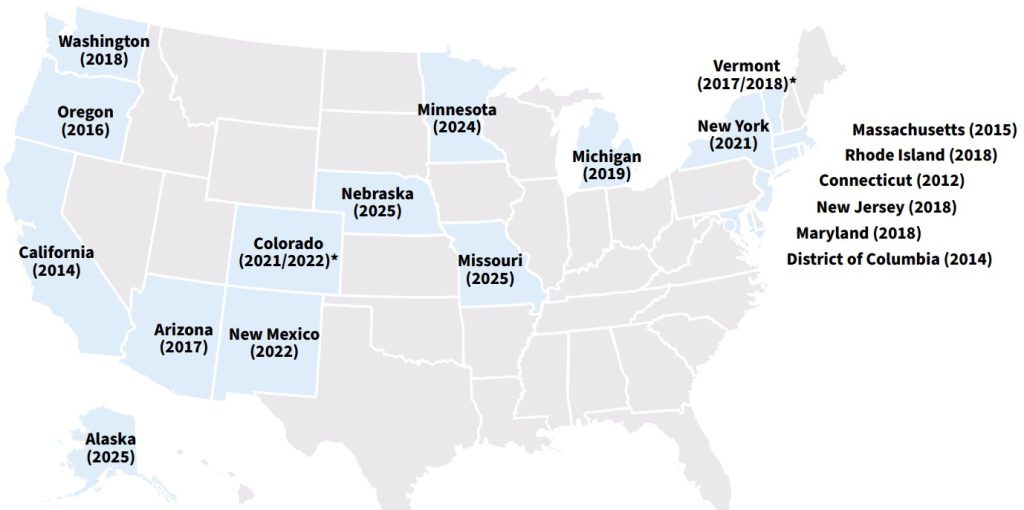

Currently, there is no federal law guaranteeing even one day of paid sick leave to workers, with the exception of federal contractors and government employees. There is the Family Medical Leave Act, but that simply provides the ability to take unpaid job-protected leave for specified family and medical reasons. There was an attempt back in 2016, where President Obama called on Congress to pass the Health Families Act which would have expanded sick leave to all private-sector workers, but it did not pass the House. Since that time, states and localities have taken action to provide all workers, within their jurisdiction, access to paid leave to care for themselves or a loved one who is sick or is receiving medical care; the list continues to grow.

During 2025, three more states will join that growing list, and mandate a paid sick leave for all private-sector workers. Employers with workers in Alaska, Missouri and Nebraska will join the other 15 states, and the District of Columbia, that have adopted paid sick leave laws.

Each state’s paid sick leave law varies in definition, thus complicating matters for those multi-state employers. Each state provides leave to care for the worker, and varies in their definition of a covered family member. The length of employment and the time available to each worker also differs by state, and in some cases, is based on the number of employees within the organization. In our summary below, some of the important points are listed, but it is noted that this is not a comprehensive explanation of the state’s law:

Alaska – Effective July 2025, workers at businesses with 15 or more employees will be entitled to one hour of paid sick leave for every 30 hours worked, up to 56 hours (about seven full workdays) per year. Those at employers with fewer than 15 workers will receive an hour of sick pay for every 30 hours worked, up to 40 hours in a year.

Arizona – Businesses with 15 or more employees will accrue one hour of paid sick time for every 30 hours worked, up to 40 hours per year. Businesses with fewer than 15 employees will accrue an hour of paid sick time for every 30 hours worked, up to 24 hours a year, unless their employer allows more.

California – Workers are entitled to at least 40 hours, or five days, of paid sick leave per year.

Colorado – Workers are entitled to one hour of paid sick leave for every 30 hours worked, up to a maximum of 48 hours per year.

Connecticut – Businesses with 25 or more workers will receive up to 40 hours of paid sick leave per year.

D.C. – Businesses with 100 or more workers will receive one hour of paid sick time for every 37 hours worked, up to seven days of sick leave per year. Businesses with 25 to 99 employees, or tipped restaurant or bar workers, will receive one hour of sick pay for every 43 hours worked, up to five days of sick leave per year. Businesses with less than 25 workers will receive one hour of sick pay for every 87 hours worked, up to three days of sick leave per year.

Maryland – Workers at businesses with 15 or more employees accrue one hour of paid sick leave for every 30 hours worked.

Massachusetts – Workers accrue one hour of sick leave for every 30 hours worked, up to 40 hours per year.

Michigan – Workers will accrue one hour of paid sick time for every 30 hours worked, up to 72 hours per year, at businesses with 10 or more employees, and up to 40 hours per year at businesses with fewer than 10 employees.

Minnesota – Workers earn one hour of sick pay for every 30 hours worked, up to 48 hours per year.

Missouri – Effective May 2025, most businesses must provide one hour of paid sick leave for every 30 hours an employee works. Very small businesses, with fewer than 15 employees, must provide at least five paid sick days per year.

Nebraska – Effective October 2025, workers at businesses with more than 20 employees will accrue and use up to 56 hours of paid sick time a year. Those at businesses with fewer than 20 employees can accrue and use up to 40 hours of paid sick time a year.

New Jersey – Workers receive one hour of sick leave for every 30 hours worked, up to 40 hours per year.

New Mexico – Workers will receive either 64 hours of paid sick leave at the beginning of the year, or one hour for every 30 hours worked throughout the year.

New York – Workers at businesses with 100 or more employees get up to 56 hours of paid sick leave per year. Workers at businesses with five to 99 employees get up to 40 hours of sick leave per year. Small businesses with four or fewer workers, earning a net income of $1 million or more, must provide up to 40 hours of paid sick leave per year. Small businesses, with a net income under $1 million, must provide up to 40 hours of unpaid sick leave per year.

Oregon – Workers at businesses with 10 or more employees (six or more in Portland) receive one hour of sick pay for every 30 hours worked, up to 40 hours per year. This may be accrued over time or offered at the beginning of the year.

Rhode Island – Full-time workers at businesses with 18 or more employees receive up to 40 hours of paid sick leave per year.

Vermont – Workers receive one hour of sick pay for every 52 hours worked, up to 40 hours per year.

Washington – Workers receive one hour of paid sick leave for every 40 hours worked.

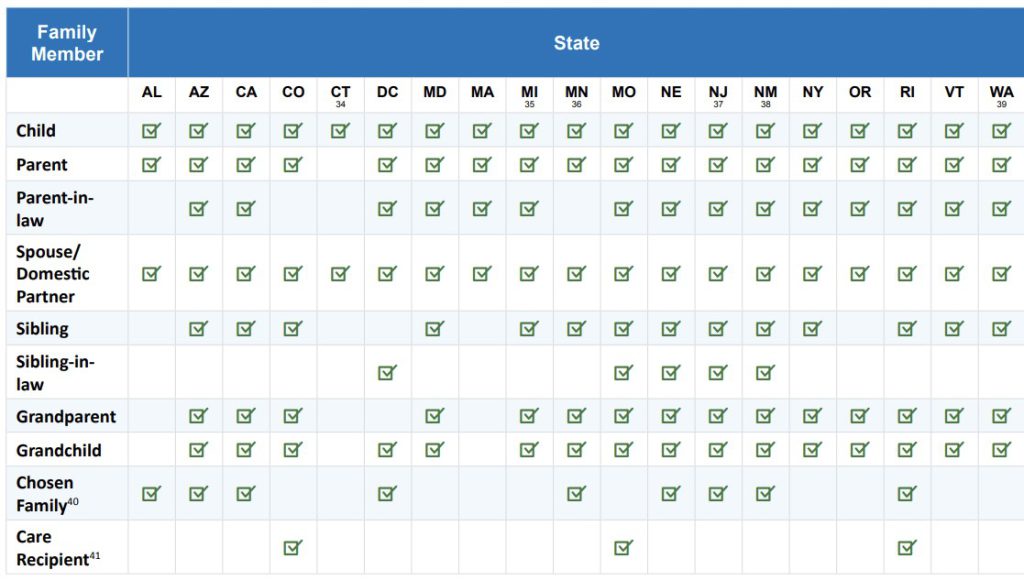

The following table summarizes which family members are covered under the sick leave.

The Department of Labor issued this brief, a few months back, providing further details of each state, but as originally stated, check with your state for full details.

If your business already provides a paid sick leave that provides at least the minimums as required, then you are all set. The best policy for multi-state employers would be to provide a time off policy that meets or exceeds the maximum requirements of the most stringent state. This way, you have a single consistent policy across your organization and all employees are treated fairly.

TIP! For employers in these newly added states, be sure you have updated your labor poster. if your current labor posters do not mention paid sick leave, then they are out of date. Our labor poster service can help you remain in compliance.

While we make every attempt to ensure the accuracy and reliability of the information provided in this document, the information is provided “as-is” without warranty of any kind. Romeo Chicco or PayMaster, Inc. does not accept any responsibility or liability for the accuracy, content, completeness, legality or reliability of the information contained. Consult with your CPA, Attorney, and/or HR Professional as federal, state, and local laws change frequently. These sick leave laws are a moving target and at least one state mentioned above, the law is being challenged.