Do you own a business in New York? Here’s some helpful links and information.

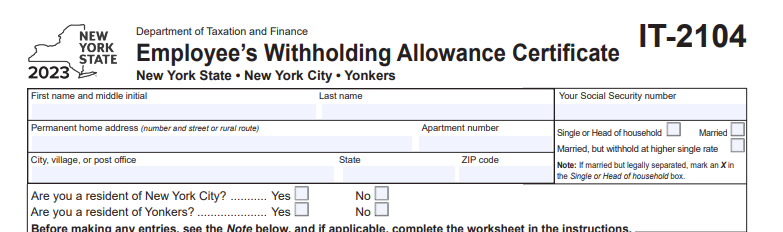

If you are an employer and you maintain an office or transact business in New York state, you must withhold personal income tax on your employees. Employers must withhold tax for:

- New York State residents earning wages even when earned outside of the state

- New York State nonresidents being paid wages for services performed within the state

- New York City residents even when services are performed outside New York City

- Yonkers residents even when services are performed outside Yonkers

- Yonkers nonresidents on wages paid for services performed in Yonkers

Form IT-2104 should be filled out by employees.

Additional information regarding New York’s income withholding tax can be found here.

New York state does not have any reciprocity agreements with any state.