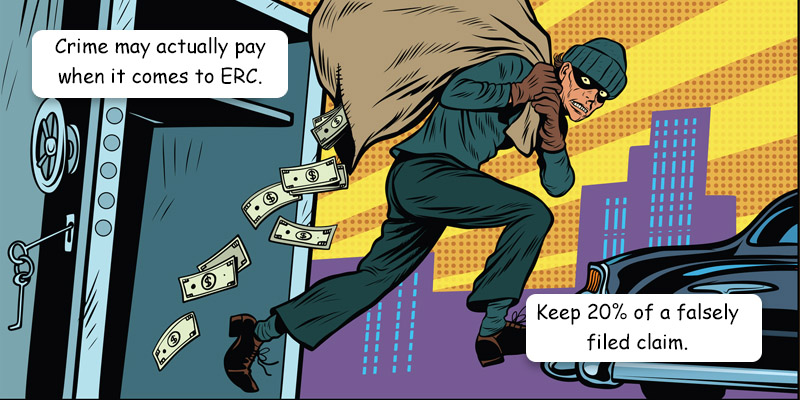

The Employee Retention Tax Credit (ERC), a program to financially help businesses adversely impacted by COVID-19, has turned into a nightmare for the IRS, as they continue to combat dubious filings. We saw back in September, the IRS announced a moratorium on the processing of claims filed after September 15, 2023, and the slower processing of returns they had received prior to that date. Then, a month later in October, the IRS urged business owners with pending ERC claims, who did not believe they were eligible, to consider a withdrawal program that allows them to remove a pending ERC claim…